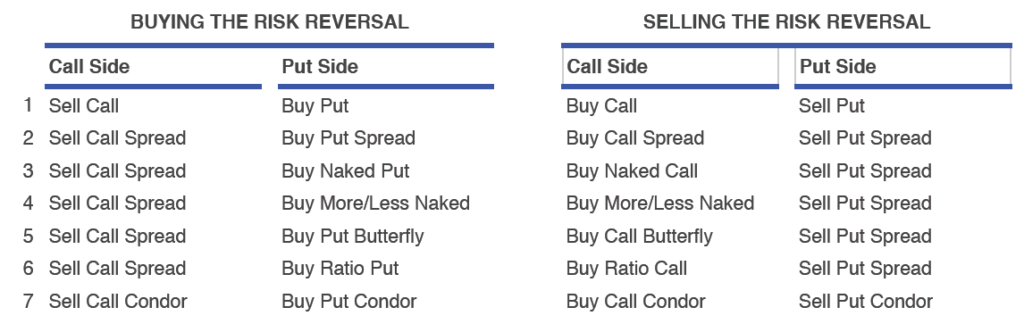

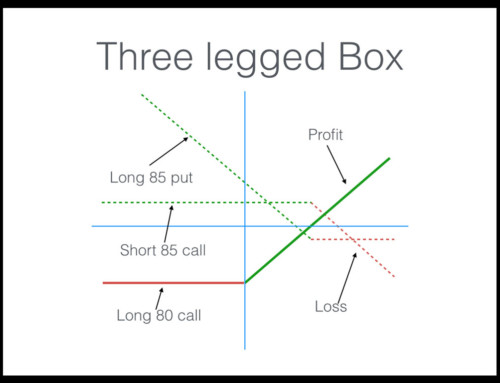

Risk Reversal is simply a collar position without the stock shares, it is the long and short call.

This strategy is really a hedge position when the stock is part of the position but, we will use this strategy as a directional play and not as a hedge. The garden variety of risk reversal is a a long put and a short call. The sale of the naked short call without owning stock is prohibitive from a margin perspective. The sale of an unprotected call will result in most brokers requiring you to put up half the value of the index, ETF, commodity or stock. The results can be very costly.

There are a lot of combinations which can be created with risk reversal dependent on your imagination. Here, We will be using the risk reversal as a vertical spread against a vertical spread.

Depending on the prices of the option, we can do this by selling a vertical spread and purchasing a naked option. It can also be done with the sale of a vertical spread and a ratio of naked options on the other side (puts v calls).

The first part is a traditional risk reversal while the second row below is what was used intensively in our book Complete Option Trading Guide to Risk Reversal and what we will initially discuss here.

This simple selling of a vertical spread to raise capital for the purchase of another vertical spread is extremely versatile and was greatly discussed in the complex and cerebral strategies such as the Layer Spreads the book of Risk Reversal however touches some of its contents in the discussion of this strategy.

As mentioned above, we will use Risk Reversal – as a directional play. The reason for the risk reversal as a directional strategy is to offset the limitations of a more simple vertical spread. A trader believing that the market is going to move higher has a couple remedial vertical spread choices.

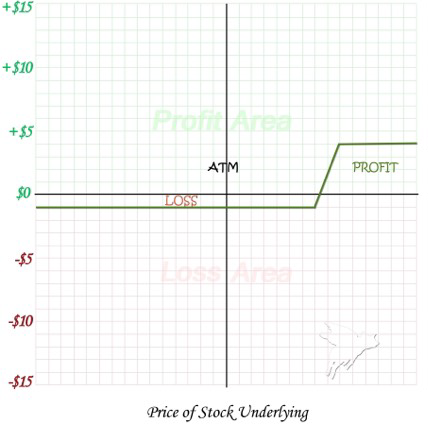

Long Call Spread

When buying a long call spread there is a cost associated with it, and usually the call spread is purchased OTM so as to obtain a good risk-reward-ratio. It would also mean that if the stock did not appreciate substantially in price, you will lose the money in your initial investment.

After buying vertical call spreads for a while, most beginner option traders believe that there has to be a better way, and they move to the next strategy – selling a put spread.

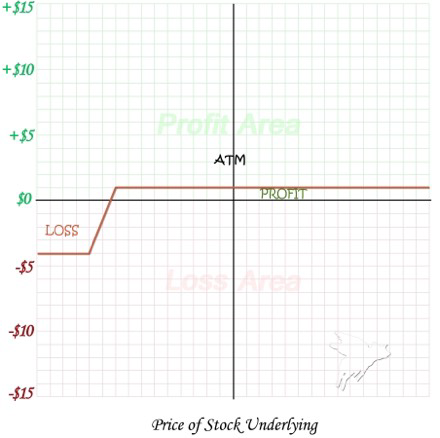

Short Put Spread

Most traders learnt that after having some long vertical spreads going against them, selling a put spread is the same as buying the call spread. The good thing with selling a put spread (or call spread sale) is that the requirements for a profit are not as demanding (typically). Selling an out-of-the-money (OTM) put spread (or call spread) allows the trader much more wiggle room for the stock to move, albeit at a sacrifice to the risk vs. reward ratio. When selling the put spread, you can make the full value of the sale price should the stock run higher, stay flat, or even fall a little.

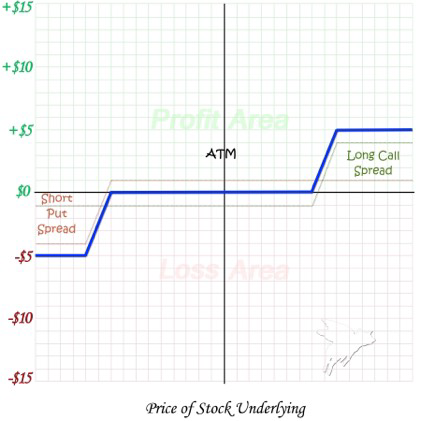

Combining the Positions

The risk reversal (which is a position when not used as a hedge) is designed to take advantage of the positive risk vs. reward ratio of the long vertical spread, and the excellent chance of success with the short vertical spread.

The best way to think of a risk reversal is as a strategic position that uses the capital from the sale of a vertical spread to subsidize the purchase of the long vertical spread.

Combining the two figures above, you will notice that the sale of the put spread brings in about the same amount of capital as the cost of the call spread purchased. This is the goal, though you don’t have to make it a perfect offset for the trade to be good. It is perfectly acceptable to pay a small debit, or receive a small credit.

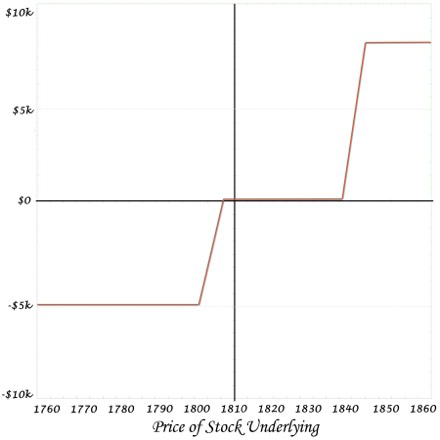

The important thing to glean from the PNL graph below is how the position does not lose money if the stock stays flat, goes up just a little bit, or falls (just a little bit). This is the benefit of the risk reversal compared to the long call spread.

Below is an example extracted from the Risk Reversal Book that deviate from a perfectly paired up and clean risk reversal. This should be enough for you to extrapolate out and understand that there really are no rules here. You can play with the strikes and contracts freely, and custom design something that you like based on market conditions and your comfort level.

Example:

We can work under the assumption that you are so bullish that you are not afraid of the stock falling in the least. The market has been very strong, had a weak temporary pullback to support levels and is taking off to the upside again. As a matter of fact, you were thinking about doing an iron cockroach (where you sell an ATM put spread, and an OTM call spread), but the volatility was just too low for selling premium to make sense.

Put Spread Sale

We know that the index cash is at $1810, so we will sell a put spread from the 1810 strike or lower. From a very quick look at the option chain and the respective put vertical spread prices, we will select the 1805 – 1800 put spread at $1.85. By selling 10 contracts of this spread, we will take in $1,850 from which to work with. One could have just as easily selected a spread further OTM such as the 1795 – 1790 for a $1.40 credit. This is purely subjective (at this point).

Call Spread Purchase

• 1825 – 1830

And since we are very bullish on the market, we will utilize every penny of the $1,850 taken in towards the purchase of call spreads. We could purchase 10 contracts of the 1825 – 1830 call spread trading for $1.85 (a $1,850 debit).

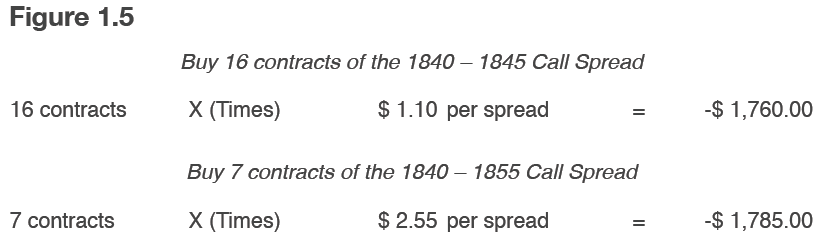

• 1840 – 1845

We could instead purchase the 1840 – 1845 call spread trading for $1.10. Purchasing 17 contracts of this spread would cost $1,870 (17 contracts X $1.10 per share X 100 multiplier). Since we took in $1,850 and are paying out $1,870, the whole combination would be done for a $20 debit. Some people are very concerned about credits and debits, not to mention commissions. Though we attempt to dissuade people from overly focusing on these considerations, you could purchase only 16 contracts (instead of 17) of the call spread. Purchasing 16 contracts would cost $1,760, leaving the combination of the trade as a $90 credit ($1,850 credit – $1,760 debit).

• 1830 – 1845 call spread

Someone wishing to purchase a large vertical spread doesn’t have to limit themselves to a $5 spread simply because the put spread sold was $5 wide. When choosing a large vertical spread, keep in mind that a large separation between strike prices is not necessarily better than a smaller separation vertical. A large vertical spread (say $15 wide) is simply the total of all the $5 spreads that make it up. The vertical spread gets cheaper as it goes further OTM, but the underlying has to move more to get there.

Analysis

Depending on the implied volatility levels and the skew, it is often better to purchase more contracts of the higher priced small spreads than it is to purchase what appears to be a better deal on the wider spread.

Math below shows how the 1840 – 1845 ($5 wide) spread can be much more powerful than the wider 1840 – 1855 ($15 wide) spread. If we start out wanting to spend roughly $1,800 on call spreads, we have enough room to purchase 16 contracts (trading for $1.10) of the former spread, and only 7 contracts of the later spread (trading for $2.55).

Back to Example

Having discussed the many combinations that can be created with varying call spreads, let’s use an example where we sell 10 contracts of the 1805 – 1800 put spread for a 1.85 credit ($1,850), and purchase 16 contracts of the 1840 – 1845 call spreads for a $1.10 debit (-$1,760). This will yield a net credit of $90 which is often enough to pay for the commissions.

Keep In Mind

We also have to keep in mind when analyzing this position that the profit potential for the call spread is much greater than the $6,240 we anticipated when pricing the spread out in the table above. The table depicts the profit and loss of the spread had we paid $1.10 per share for the spread, or $1,760. But we took in $1,850 from the sale of the put spread.

We can make a total of the distance between the strikes multiplied by the number of contracts, plus or minus the credit/debit. Because we can make $5 on 16 contracts, we can make $8,000. Also, we will be taking in $90 as a credit, so our total profit potential is $8,090. The profit and loss graph looks as shown below:

Side Note:

If confused about probabilities, how we came up with the math, what a SD (Standard Deviation) is, etc., please refer back to one of the core e-books available through Random Walk – Level 2 – Option Trading Guide to Broken Wing Butterfly (BWB), Level 2 – Beginner’s Option Trading Guide to Time Spread, Level 3 – Option Trading Guide to Understanding the Greeks, or Level 2 – Option Trading Guide to Collars: Learn to Protect Your Stocks. Each of these texts have a section in them explaining what the 1SD band is telling you, and a simple “down and dirty” method of calculating it should your broker’s website not provide that information.