During his interview with CNBC, according to Mark Mobius, the founding partner of Mobius Capital Partners:

“Physical gold is the way to go, in my view, because of the incredible increase in money supply,” said Mobius, in the interview. “All the central banks are trying to get interest rates down, they are pumping money into the system. Then, you have all of the cryptocurrencies coming in, so nobody really knows how much currency is out there.”

He even told Bloomberg last month that we should buy gold more because it will continue to go higher.

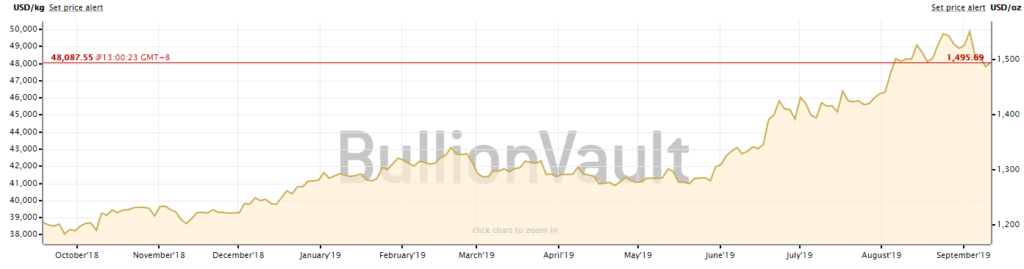

And while it was down by almost $57 per troy ounce from Sept 3’s high of $1,551.41 and only went up modestly by more than $7 from Sept. 9, we don’t see it going back to this year’s low of 1,271.52 anymore. The rally on gold may have slowed down, but we see it stabilizing in 1500s and may not be going down triple digits in the future.

In the interview, Mobius is all bulish on gold. He recommended a 10% physical gold in the investor’s portfolio sighting that the dollar will get weaker in the months to come with Trump’s attempt to boos U.S. exports.

“They are certainly going to try to weaken the dollar against other currencies and of course, it’s a race to the bottom. Because, as soon as they do that, other currencies will also weaken,” said Mobius. “People are going to finally realize that you got to have gold, because all the currencies will be losing value.”

Aside from this, central banks globally are cutting their interest rates. Last month, Central banks in New Zealand, India and Thailand lowered their interest rates by higher points than any one can expect. The Reserve bank of New Zealand cut its rate by 50%, twice the expected cut rate while the Reserve Bank of India and Thailand cut their rates by 35 and 25 basis points respectively. The Reserve Bank of Australia had cut their rates too last June and July.

Central banks often resort to this easing of rates to boost money supply in the economy and provide stimulus to growth but this also sends out a clear message to its respective countries and to the rest of the world.

By pumping the traditional currencies and the adoption of cryptocurrencies globally, it is hard to guess how much currency is really circulating, the currency in effect losses its value.

Among other forms of currency, gold retains most of its value and is more stable globally.

“At the end of the day, gold is a means of exchange. It’s a stable currency in some way,” said Mobius.

China is investing in Gold

Amid tensions on US – China Trade war, spot gold had hit a six-year high of $1,554.56 in late August and in the same month, The People’s Bank of China reported an increase of 6 tons in its gold reserves.

They have been stacking up gold for nine (9) straight months since December 2018 getting 10 metric tons in July and 6 in August as stated above. Here’s another statement of Mobius regarding gold in China:

“China is the biggest producer of gold to begin with. And then of course, they’ve been buying gold, so nobody really knows how much they have in the vaults,”

“I’m sure it’s been increasing at a pretty good pace.”

But there’s another entity hungry for gold…

Central Banks are also buying gold

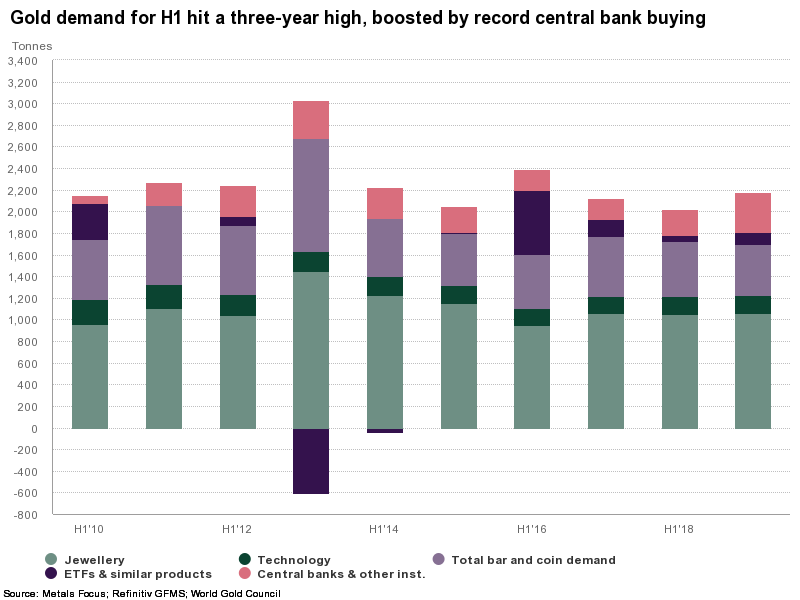

According to the World Gold Council, central banks amassed 374 metric tons of gold just in the first half of the year.

“Deep down inside, the central bankers do believe in gold, but they don’t want to say it because … they won’t be able to create new currency,” said Mobius.

According to poll, 11% of the emerging markets and developing economies intend to buy more golds in the 12 months to come. This is lower by just 1% last year whereby 12% of these markets bought gold raising the central bank gold demand by 652 metric tons – the highest level on record according to the World Gold Council.

According to the council, “The planned purchases are being driven by higher economic risks in reserve currencies. In the medium term, central banks see changes in the international monetary system, with a greater role for the Chinese renminbi and gold,”.