After Seven Months into the Pandemic

Gold continuously moves higher in the past months and [...]

Wirex joins MasterCard Crypto Program

Cryptocurrency is here to stay. The banks know about [...]

What happens after pandemic?

"It wasn't raining when Noah built the ark" ~ [...]

Bitcoin amidst Trade War and Currency Issues

After the 2017 rally which recorded an all-time high [...]

Introduction

Traditional collars are designed to make money in weak and strong bull markets. They are also excellent tools which allow the investor to remain calm while the market crashes around him. Traditional collars are literally the best strategy for “dollar cost averaging.” Why do you think Warren Buffett does it? A few individuals claim that collars don’t work, but they have far less net worth than Mr. Buffett, so who do you believe?

If you are a beginner and not that familiar to collars, Randomwalk’s Level 2 – Option Trading Guide to Collars: Learn to Protect Your Stocks should be able to get you on your feet.

Collar’s Downside

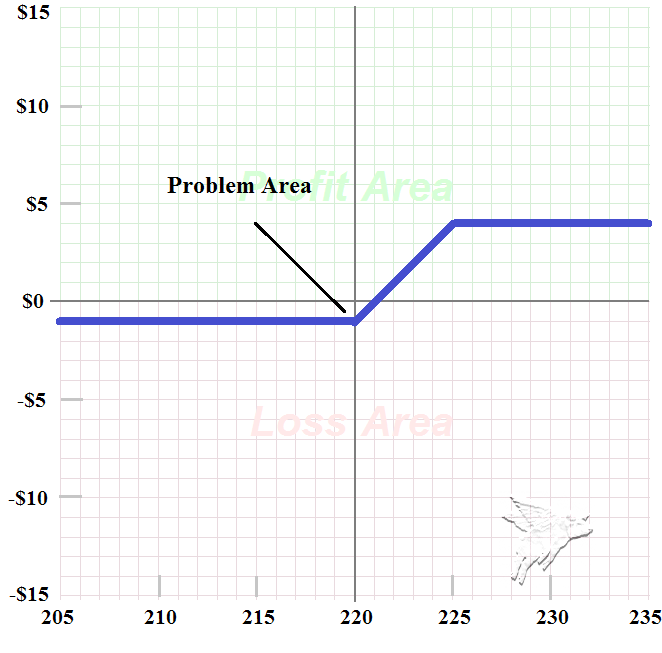

The downside to a collar is NOT a sudden market crash, as many would think. Collar positions can be frustrating when the market is in a slow and steady decline. Recall that the profit and loss graph of a collar looks like a long call spread. If we are long (looking at the) 220-225 call spread in a stock like XYZ or AAPL, then we know that we will lose the entire investment capital at $220 or lower in expiration.

With a collar, however, once the stock goes below $220, we want it to go down as far as possible as long as we still think the company is a good investment. Why? Because you will be able to sell the protective put out to bring in cash that you can use to buy more stock at lower prices.

Common Sense Approach

The easiest way to understand this is to think about it in pieces.

Stock– We want the stock to go up, because it will incur a loss if it goes down.

Long Put– The put loses everything at the strike price or higher. So if the stock closes at the exact strike price, you will lose everything and have to buy a new put for the next month.

Short Call – As long as the stock closes at the strike or lower, the short call will go out worthless.

If the stock closes exactly at the put strike, you will only make money on the short call that expired worthless. You will also have to buy the put again for the following month. The problem with this is that the ATM put is going to be very expensive so it is not recommended by the half EM formula. You will have to buy an OTM put.

In bear markets, the worst that can happen to a collar is if the stock slowly declines to the new put strike because you will lose more money. If it happens again the next month, the stock price will slowly continue to go down. The long put won’t pick up intrinsic value, and is essentially just there for show.

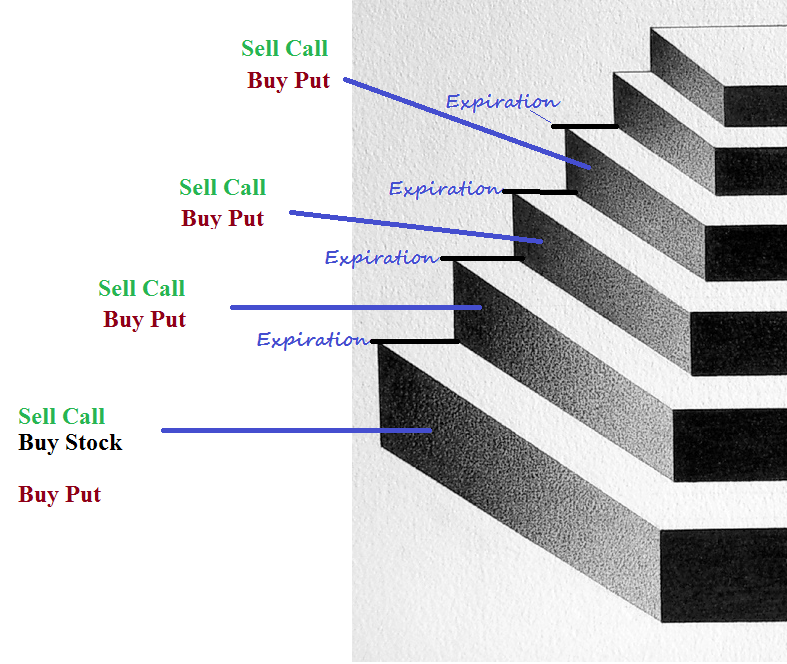

This scenario is the exact opposite of what you want to happen with a long collar. With the long collar, you hit a huge home run if the stock slowly appreciates every month until it reaches the short call strike on expiration. You can then roll up the long put and short call like walking up a profit staircase.

But just as you can walk up a staircase towards profit, the same staircase can also be used to walk down. Although a collar is a vastly superior position (under most circumstances) to simply buying and holding forever, many people fail to take advantage of the bearish collar during bear markets. Bear markets are just as common as bull markets. They prevent everyone from playing the market all the time, and they break the instruments because of their ever-expanding bubbles.

But, just because we have been conditioned by brokers, the media, and analysts to fear bear markets, they are not always negative. A power saw is a wonderful tool to have when building a home. Instead of using an ax and a handsaw, a power saw can decrease the time it takes to build a home by 90%. Yet, if you give that chainsaw to a kid, then you will likely see damage from its misuse. A chainsaw is an inanimate object just like the numbers scrolling across your computer screen. Your concept of what those numbers mean, not the numbers themselves, dictates if they are good or bad. You need to learn to embrace the bear market since it is never going away.

History

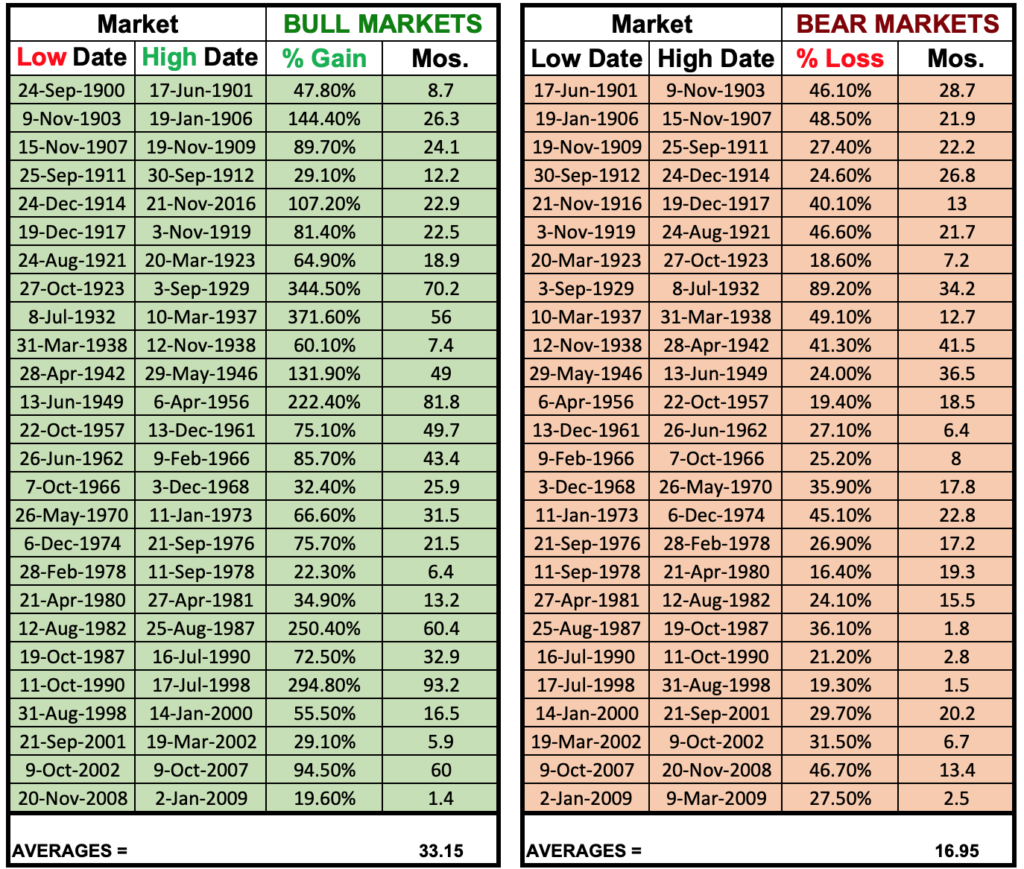

During the 20thand 21stcentury, we had 27 bull markets and 26 bear markets. Bull markets tend to double on average in just under 3 years. Bear markets drop (on average) over 1/3 in a year and a half The market is statistically in a bull market about 67% percent of the time and a bear market about 33% of the time, but the 10 “mini” bull markets in the 1930s were statistical aberrations, and lasted an average of only three months each. These anomalies considerably skew the percentages, and if they were taken out, then the bull versus bear ratio would be closer to 50/50. That sounds a lot like what Random Walk has been preaching all along about the markets being unpredictable.

In order to give you a better understanding of how bull and bear markets are opposite sides of the same coin, we prepared a historical chart of the markets since 1900.

The chart shows that, if you take the abnormalities of the Great Depression out of the equation, there are an equal amount of bull and bear markets. Some people think that this means that you can only make money 50% of the time, but why not try to play the bear side to win as well?

The collar WILL help you dramatically in the downturn and will theoretically allow you to make much more than the “buy and hold” people who will ride the bear markets all the way down.

Long Collar

Random Walk preaches against trying to time the markets – it is just too hard to be consistently successful at this. This means that with almost every position you have on that you are riding a trend with, you are going to have a bad expiration month with that position.

Suppose that you are blind, mute, and deaf, and you are traveling a few hundred miles away on a train. You know only that your stop is the second to last one. You don’t know how many stops there are between your current location and the end. What is the best way to get to your goal in the least amount of time?

Attempting to predict the second to last stop in the line can prove very difficult. With each passing minute you become increasingly afraid of overshooting your stop, and the ride begins to seem long. You can’t take the anxiety anymore, so you finally get off at the next stop. You read the braille sign on the wall and find out that you are still miles away from your destination. Now you have to wait two hours for the next train to come.

What is a better strategy? You should just take the train all the way to the end, and when you feel the train reverse directions, you will know that you will reach your exact destination by getting off at the following stop. Given your limitations, this is the best way to navigate the train. Yet, in the stock market, most people exit the trend early, and then they are forced to wait until the next time. Why?

We are so afraid of giving back profits that we hop off the bullish stock train. We are worried that it might reverse directions and we will give back financial ground. Does this sound ridiculous? Of course it does, but we all do it. We can rationalize anything, even if our thoughts are completely out of touch with reality. This is what Jesse Livermore meant when he said, “Stocks are never too high to buy, or too low to sell.” If you are on the right side of a trend, and you are trading it correctly for all it is worth, then you should ride it all the way to the end. You will give back some profits almost every time since you will get out after the second to last stop, but since you don’t know how long the trend will last, you will hopefully be in the trade well past the 3rd, 5th, and 7thstation. The profits you give back will be miniscule compared to the extra profits you gained by staying in longer than your gut told you.

Let’s use another analogy to illustrate our point about trusting our trading tools, even if they are going against your intuition. When getting a pilot’s license, you have to learn to ignore what your body is telling you and trust your instruments. We have hair fibers in our inner ears called cilia. These fibers are suspended in fluid and take a while to adjust if they are disrupted. When turning your plane for an extended period of time, the hair fibers adjust so that you maintain your balance in the bank. If you quickly straighten the plane out of the turn, your inner ear will still tell you that you are turning at first even though you are not because it needs time to readjust again. You must learn to ignore your instinct, and do what you know is right based on what the instruments are saying. The same applies to trading.

Many people have a hard time staying in winning trades for a long period of time, but they can stay in a losing trade forever. Their trading “cilia” is not correctly aligned yet, and their instincts are leading them in the wrong direction. This is the OPPOSITE of what you should do. We ignore what our instruments are telling us as truth because it is hard to admit that we are wrong, or because we are afraid we won’t make back the money if we get out of a losing trade, or because we have an emotional and financial investment in the trade. We can easily become backwards traders. If you find yourself doing this, STOP EVERYTHING, take a walk, and remind yourself of the truth.

If you find yourself staying in a collar position (or any position for that matter) longer than you feel comfortable, go back to your book/e-book Level 2 – Option Trading Guide to Collars: Learn to Protect Your Stocks and review the material about alternative ways to play a collar. Also, if you have, you can read the material Trading Psychology . If that doesn’t work, call the office, and set up a consulting appointment with our trader to work through the problem.

Staying In

Now that you are hopefully riding your positions longer, you must come to grips with being in at the top when the market reverses. How will you know the difference between a market reversal and a short-term pullback before the next wave higher? You won’t at first. One, two or three days of the market going in the wrong direction will usually not be proof that the bull trend is over. You should avoid the temptation to get out of your trade. The first pullback is usually just a rest stop where the weak people are taking their profits and running from the market before the next big wave higher. In the past, you might have panicked at this point, but with your new knowledge, you can now remain calm.

Don’t be one of the 200 people trying to squeeze through the door in the crowded movie theater just because some kid jokingly yelled, “Fire!” You have a collar on and you are protected. In this situation, you are often better off holding on. If the stock falls through the put strike, just let it keep falling.

Some people like to sell the put out and use the intrinsic value that the put picked up to buy more shares. Instead, you should just relax and let things play out. Usually, the best thing you can do is hold the position until expiration, and roll the calls down a strike to take in more time premium. We saw from the “bull and bear market chart” that the average bear market lasts 16.95 months. Missing the first month in exchange for a better certainty that the bull market is over is an excellent tradeoff. This is the equivalent of to waiting until the train pulls into the station and then taking the train back one stop when it goes the other way. Jumping off the train between stations will only cause pain along the way. Once you are convinced that the market has reversed, you can change the collar to a reverse collar.

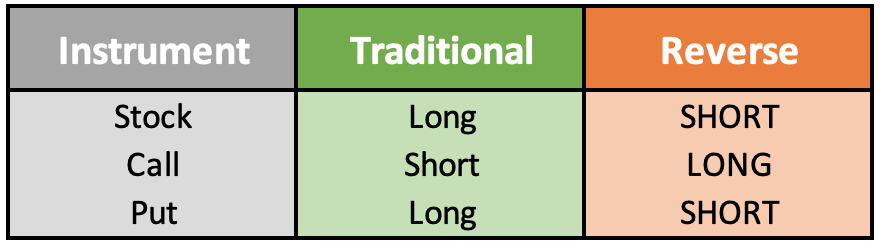

Reverse Collar

The reverse collar is just what the name implies – the collar in the opposite direction. Whatever one would do in a normal collar is simply reversed. For example:

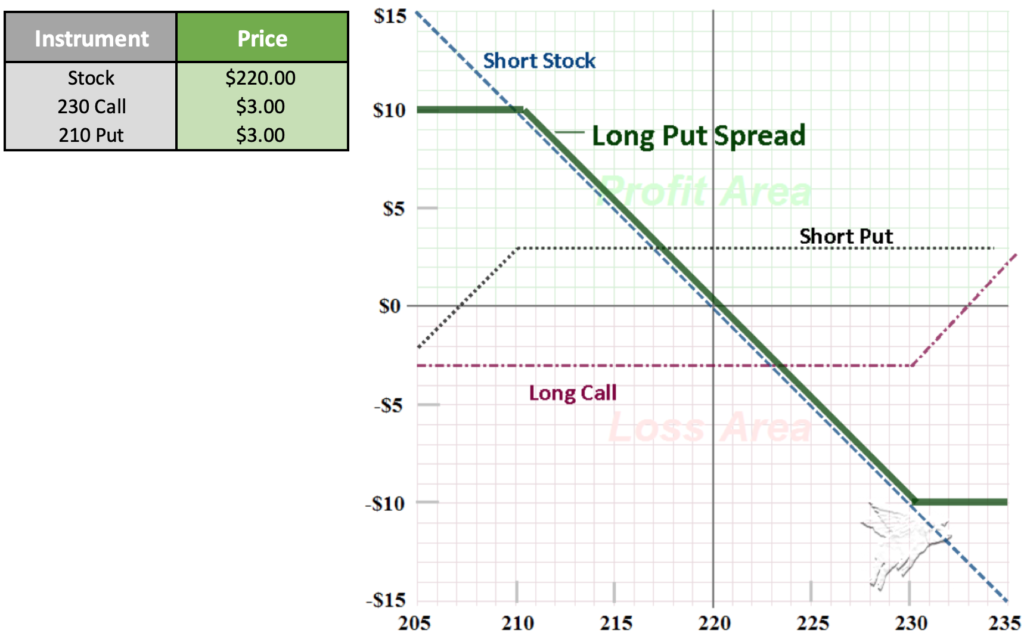

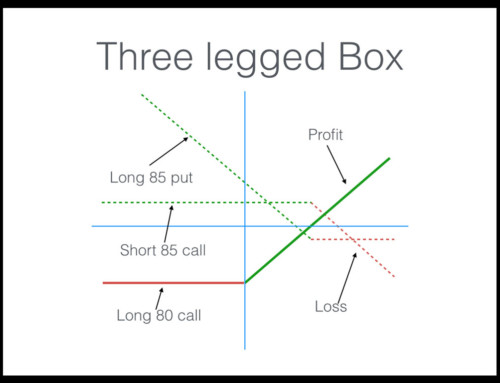

Vertical Equivalent

We already know that a long collar is mostly equivalent to a long call spread, and its PNL graph looks exactly the same. A short collar will, therefore, look exactly like a long put spread.

Let’s put some real numbers into a PNL graph of AAPL stock so we can get a better idea of what we are talking about. The following numbers will be used to create the PNL graph:

Expiration of Short Collar

Just like a traditional long collar, the short collar will close itself out at expiration if the stock closes beyond either the put or call strikes.

Stock Closes Between $210-$230

In the short collar graph example above, we sold the 230 call and bought the 210 put. Should the stock close between $210 and $230 on expiration, the option portion of the collar will expire worthless and you will have a naked short stock position, just like if you had a long collar.

Stock Closes at or below 209.99

Because you are short a put that is going to be ITM, the owner of the put will have his long put automatically exercised. Since his long put will result in the sale of stock, you will be forced to buy the stock at the strike price of $210. Yet, because you have a short stock position, the purchase of long stock will close out the short stock position. Obviously, the long 230 call will be a good deal OTM and will expire worthless.

In summary, the short put will close out the short stock position and the long call will expire worthless. Nothing will be left of the short collar.

Stock Closes at or above $230.01

Should the underlying close at or above $230.01, the long 230 call will expire ITM. Since you are long a call that is expiring ITM, the call will result in the purchase of stock. The short stock position you have in the short collar will be closed out by the call exercise. The short put at the 210 strike will be a good deal OTM and will expire worthless. So, just like the other example where the stock closed below the put strike and disappeared completely, the same will happen if the stock closes above the call strike.

MARGIN

For those who have never shorted stock before, the topic of margin may come to mind. The margin for short stock is the same as for long stock – half the value of the stock. If margin on a long stock is not a problem, margin on a short stock shouldn’t be either. Also, if you are one of the people who qualify for risk-based margin at thinkorswim, the margin on one of these positions will become negligible. If you think you qualify for risk-based margin at TOS, please contact them for details.

Alternative Methods

There are some instances where you can’t or don’t want to sell your stock. These are usually tax related circumstances where selling the stock will result in a large tax burden. These scenarios require special considerations because you have to hold onto a stock in a bear market – and nothing is more frustrating than knowing which way the market is going and being unable to do anything about it. However, there are a couple of things you can do.

Longer Term Put Near Term Call

If you believe that your stock is going to be under considerable pressure for a while (several months to a year), you can purchase a put with 4-6 months of time remaining until expiration. This will save you the trouble of having to roll the put every month. Rolling every month is usually a good thing because, if the put goes ITM, it is usually because of a temporary sell-off. You will take the IV you collected by the sale of the put and run.

But when the stock is selling off every day, week, and month, you don’t want to roll because rolling costs money. You will have to sell your near-term ITM option that has a little time value (due to the fact that it is so deep in-the-money) and buy a near term option with a lot of rapidly decaying time value. You will also be buying an OTM put, so the stock can sell off a few more dollars before it goes ITM.

By keeping your longer term option in position, the stock can keep sailing down and you don’t have to worry about rolling the put down and out (a month). In addition, you will be offsetting much of the time premium you purchased when you bought the put by selling a close to ATM call in the near term. The call option has very little time remaining until expiration, thus it will decay quickly and you can then sell another call option at a lower strike at expiration.

Eventually your call options will be below the put strike you bought, but that is not a big deal. You are in different months, so you won’t have a conversion. Remember to make sure you keep an eye on your position at all expiration dates. If the short call goes ITM, it can be assigned and you will lose the stock you don’t want to sell. Also, NEVER forget about the put. Since it’s ITM, you have to sell it out on its expiration date or you will lose the stock because it will be exercised.

Fear

After the market does a good deal of selling off, people are afraid that it will bounce back too quickly. Typically, the rebound won’t be so dramatic that you can’t clean up your position in time for you to sell the put out and buy back the short call. By now you should know that you will miss the bottom, but if you are still nervous, you can sell call spreads instead of just calls. If the market does bounce back and goes through the call strikes too quickly, then you can still participate in the run higher – you will only miss out on $5 of the run (or however wide the spread is).

If you want to know everything about Collars, you can get the following e-books: