“We should remember that good fortune often happens when opportunity meets with preparation.”

―

When the Feds declared a cut by a quarter-point in the current rates, the investors got disappointed and the market went down with DJIA closing at -1.2% while SPX lost 34 points and NASDAQ by 98 points.

Related Topic: Feds Cuts Rates, Investors Unhappy

Last Monday, right after China hinted on weaponizing their currency in relation to US-China Trade War, the indicators went down again. Here are the data according to Yahoo Finance:

- S&P 500 (^GSPC): -2.98%, or 87.31 points

- Dow (^DJI): -2.9%, or 767.27 points

- Nasdaq (^IXIC): -3.47%, or 278.03 points

- 10-year Treasury yield (^TNX): -12.4 bps to 1.731%

- U.S. dollar index (DX-Y.NYB): -0.64% to 97.45

- U.S. dollar to onshore Chinese yuan rate (USD/CNY=X): +1.54% to 7.0457

In Tuesday, the market gained some of its losses after Yuan went stronger than expected, but the moves are still not enough to fully recover from last Monday’s losses. Here are some of the market movements again from Yahoo Finance:

- S&P 500 (^GSPC): +1.3%, or 37.09 points

- Dow (^DJI): +1.22%, or 312.93 points

- Nasdaq (^IXIC): +1.39%, or 107.23 points

- 10-year Treasury yield (^TNX): -2 bps to 1.716%

- U.S. dollar index (DX-Y.NYB): +0.12% to 97.64

- U.S. dollar to onshore Chinese yuan rate ( CNY=X): -0.334% to 7.0222

Given how volatile the market currently is, we may want to protect ourselves from these drastic movements. We may also want to take the opportunity that this volatility may post by being prepared. At Random Walk, all we want is for you to face the tides all geared up.

This strategy, the Black Ops Strategy, was conceptualized with the US Navy Seals in mind. In this strategy, we will learn more of how we hold, adjust and manage a group of positions rather than learning a new strategy. This is not a new strategy but a game plan. As the book suggests,

“Black Ops strategy as a defensive position (to protect in a declining market), the same modus operandi can be flipped on its head and be used as an offensive strategy for bullish markets. Simply replacing the puts with calls does the trick. But in the end, and given enough of a move in one direction as minimally required, the strategy will likely end up being both a bearish and bullish position nonetheless.”

To be able to fully understand Black Ops, it is crucial that you are proficient in Vertical Spreads. So, hurry up, grab your basic book, flip to Chapter 7 and refresh your mind on the Vertical Spreads Strategy. Alternately, you can read a more advanced vertical spreads strategy in the Essentials Book. If you don’t have one yet, check this out:

E-Book: Level 2,3,4 Essentials To Intermediate Option Trading

Related topic: Vertical Spreads: An excerpt from the E-Book “Essentials”

This strategy can be used on the following markets:

- Under the Sea – This strategy is effective on falling markets. The spread can add a huge hedging potential at a minimal cost.

- Air – It can also be used for bullish markets.

- Land – When the market is at sea level, drifting around, no losing or gaining ground. Here, we will be playing with long and short vertical spreads and arranging them in a way to maximize profit while minimizing risk. Most of the time we will begin with the purchase of a spread that is a decent amount of money OTM (out-of-the-money) but still has a realistic chance of ending ITM (in-the-money).

Now, let us learn by example. The two main categories of a BOS spread are:

- Hedging

- Cheap Speculation

Hedging

Let us start first with the advantages and disadvantages of a long delta position.

Position: A trader owns a basket of stock and want to hedge it for whatever reason.

Market Falls: When the market falls, he will be losing money on the long deltas (stock or options), but the protective put / put spread offsets much of the loss.

Market Bounces: When the market bounced back, the selling was temporary and the run higher was almost inevitable. The put spread that gained a good deal of profit is now giving back all that profit, and may even be trading for less than what it was purchased for.

The Dilemma is: while you were very grateful for that protective put spread when the market was falling, you will now no longer need it. You almost wished you sold that put spread out when it had a good profit in it, but that is read hard to do when the market is falling. And you are afraid to sell out of the put spread now because the market is back at the exact same spot it fell from originally. You are at a mental crossroad.

Here are the problems faced with being long deltas and having a protective put/put spread in a falling market.

Key Problems Dilemmas

One – You keep the put spread and then the market keeps falling

When the market fell, keeping the put spread allowed a put spread profit cushion against the continued long delta losses (either through options and/or stock positions). Had you not had the put spread you could have faced a painful day.

The negative side is that, Though being long a put spread is preventing large losses from the long delta side, you are likely still losing a little money (unless over-hedged). In addition, anyone who has been trading long enough knows that there will eventually be a bounce. That long put spread that may have gone from $2, to $7, to $9 will eventually go back to $2 at the first strong bounce.

Two – You keep the put spread and then the market bounces

During the bounce (following a market drop) you make money on the long delta portion of your position, but you are really just making back money. The put spread portion of the trade quickly gives back the profits it acquired on the way down. Just like the long put spread neutralized your position’s profit-and-loss (PNL) on the way down, it is going to make your PNL on the way up inert. All the profits from the put spread will evaporate.

During the bounce (following a market drop) you make money on the long delta portion of your position, but you are really just making back money. The put spread portion of the trade quickly gives back the profits it acquired on the way down. Just like the long put spread neutralized your position’s profit-and-loss (PNL) on the way down, it is going to make your PNL on the way up inert. All the profits from the put spread will evaporate.

Three – You sell the put spread and then the market keeps falling

An optimist would say the positive is that the loss from the long delta portion of the trade was at least stopped for a while.

The real problem most traders face in this scenario is when you can not take the pain of loss any more, you go out and hedge the position. It is often precisely at this moment the market turns to the upside and the hedge is an anchor to regaining capital.

Four – You sell the put spread and then the market bounces

The negative thing here is that you are taking a big risk getting out of your safety harness before the ride has come to a complete stop. There should be an intellectual reason for getting out, such as:

• The market has begun to bounce

• The VIX is so high that statistically it makes sense

• Your hedge can not make much more anyway (a component of Black Ops)

Given all these scenario, what is the solution? BLACK OPS

The Black Ops Concept

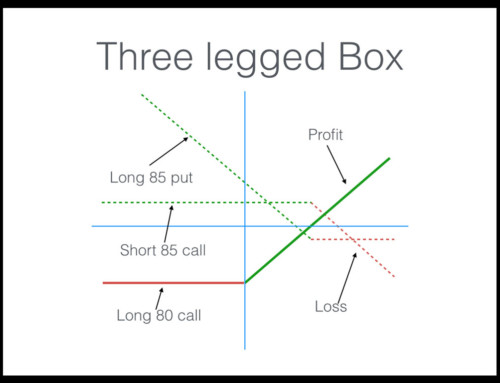

In the above scenario, what are we going to do with the long put spread when the market is moving? What we are yet to discuss is another

alternative which is to sell something against the existing long hedge to take money off the table at the same time leave on a hedge that still offers some protection. This is where the BOS starts.

Let us make an example to illustrate one piece of the BOS trade. After this is understood we will string several pieces like this together and create the BOS.

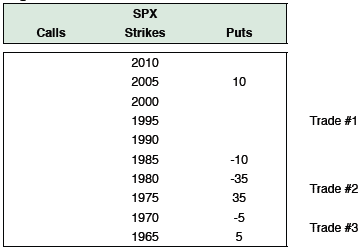

SPX movement and Trades Placed

Remedial Example Trade #1

On this particular day, the markets had opened down dramatically with the SPX opening down 28 points and the Dow was down about 200. Realizing that things could get worse, we waited for an opportunity to add additional protection (which will make sense later). Roughly 1 hour after the open the SPX had bounced off the morning lows and was down roughly 18 points, so we took this as an opportunity to purchase a $20 wide put spread.

Trade #1

Trade above is the actual fill showing that we purchased the 2005 – 1985 put spread for a $5.50 debit on 10 contracts.This is a $5,500 investment that obviously has risk associated with it. Had the market bounced $50 to $100 SPX points over the next few days we would have seen this spread’s price decimated. Since we were carrying long deltas, however, we could loose a lot more than the $5,500 had the market continued to fall without the protection.

Remedial Example Trade #2

Roughly an hour after having been filled on Trade #1, the market had fallen back down to the lows made at the open. We bought the put spread when the SPX was down 18 points and now it was trading down roughly 28 points.

Our concern was that the market may be making a double bottom for the day. The reasons for this were:

- The markets were down dramatically for what we thought the news would dictate.

- Many down opens are overreaction to news and people caught on the wrong side of the move (long when the market is lower so they are panicking to sell).

- We already had a very weak market the whole week with the SPX being down 3% for the week.

Trade #2

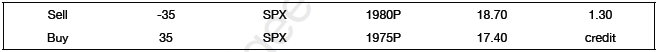

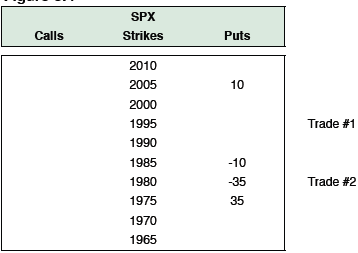

Recall that Trade #1 was a put spread that created a $5,500 debit in the account. Though the hedge was needed, this is still $5,500 of risk. Selling 35 contacts of the 1980 – 1975 put spread at $1.30 brought in $4,550 ($1.30 per contact X 35 contracts X 100 multiplier).

By selling put spreads that were further OTM (than the spreads purchased), we were not adding risk of loss to the account. As a matter of fact, we could have sold up to 40 contacts, but chose not to.

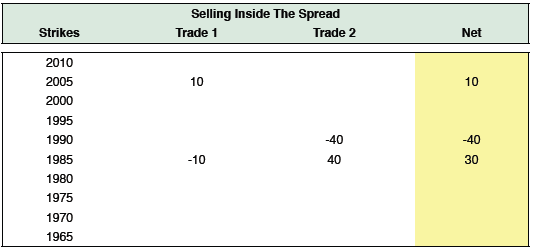

Our position now netted out looking as follows:

Remedial Example Trade #3

Many students, traders, and observers of the markets have seen the acceleration higher that takes place off of a strong bottom. When the market participants realized that a market bottom has taken place at that moment, and the markets scream a sigh of relief, it is not uncommon to see the Dow shoot 200 – 300 points higher in a 15 minute period. By reducing our risk to $950 we felt comfortable holding onto the trade.

As things often happen in fear and panic situations, especially going into a weekend, during the last hour of trading the markets took a steep descent with the SPX down over $40. We felt this was capitulation selling, so we sold out the last 5 spreads available.

Because of the additional selling that took place from the time we did Trade #2 (from SPX down 28 to SPX down 42) We were able to sell the last 5 contracts better. We received $1.40 (instead of $1.30), and we were able to move down to the 1970-1965 strikes (from the 1980 – 1975 strikes in Trade #2). This ancillary benefit would prove common sense was correct. Since the market had sold off additional 12 points we should by definition be able to move down $10 in strike prices and get at least (if not more) premium. Trade #3 is as follows:

Trade #3

After the trade was executed our totals came out to be matched up on profit potential against risk liability. We could make up to $20,000 on our long 2005-1985 put spread vs losing $20,000 on a total of 40 contracts of different $5 spreads. Also, before selling the last 5 contracts at $1.40 we had $950 of risk into the trade. After selling 5 contracts at $1.40 we took in took in $700 ($1.40 X 5 cts X 100 multiplier), which now brought the total dollar risk of the trade down to $250 (-$950 trades 1&2 + $700 trade 3).

The final position on one’s trading sheets would look as follows:

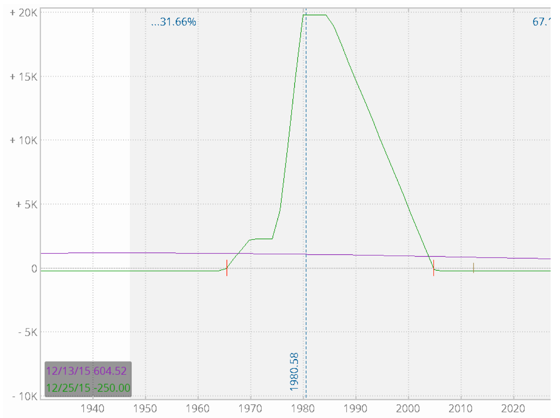

Below is a PNL risk graph of the completed trade (Trades 1, 2, 3). What is enthralling about this graph is the range of profitability this trade engulfs. An expiration price between 1965 and 2005 creates a profit which can be maximized at $20,000 (minus the $250 debit).

There is a 40 SPX point range where the trade makes money. This can also be thought of as a 40 point range of protection against a long delta position. A 40 point range on a 2,000 point index equates to a 2% range. Since the trade has been placed with an expiry cycle of 2 remaining weeks, this is pretty good news. The more interesting and encouraging piece of information is that the market closed just above 2005, making this trade an ATM spread.

Interesting facts about this position

One – This position will have the positive time decay benefit of the “concave down-decreasing curve” in our favor. Our favor since this position is currently at the-money position with less than 2 weeks remaining to expiration. The position will continue to increase in value as if we had on a long butterfly position should the market stagnate near the SPX $2,000 support-resistance line.

Two – The position is essentially at-the-money with long put starting at 2005 and maximizing out at until SPX 1980. That is a $25 point move from current levels where the position acts as a naked long SPX put.

Three – Though this position does not offer the same benefits as that of a long put spread where any index value below the lowest strike price ensures maximum profitability, it eliminates the premium investment risk almost altogether.

Four – Under most normal circumstances this position alone would provide adequate protection of a very large account, the BOS is needed when normal conditions do not apply.