Table of Contents

CHAPTER 1 – Vertical Spreads

Section 1 – Vertical Spread Concept

Section 2 – Vertical Spread Basics

Section 3 – The Greeks

Section 4 – The Box

Section 5 –Early Exercise Equity Option

Section 6 – Vertical Spread Criteria

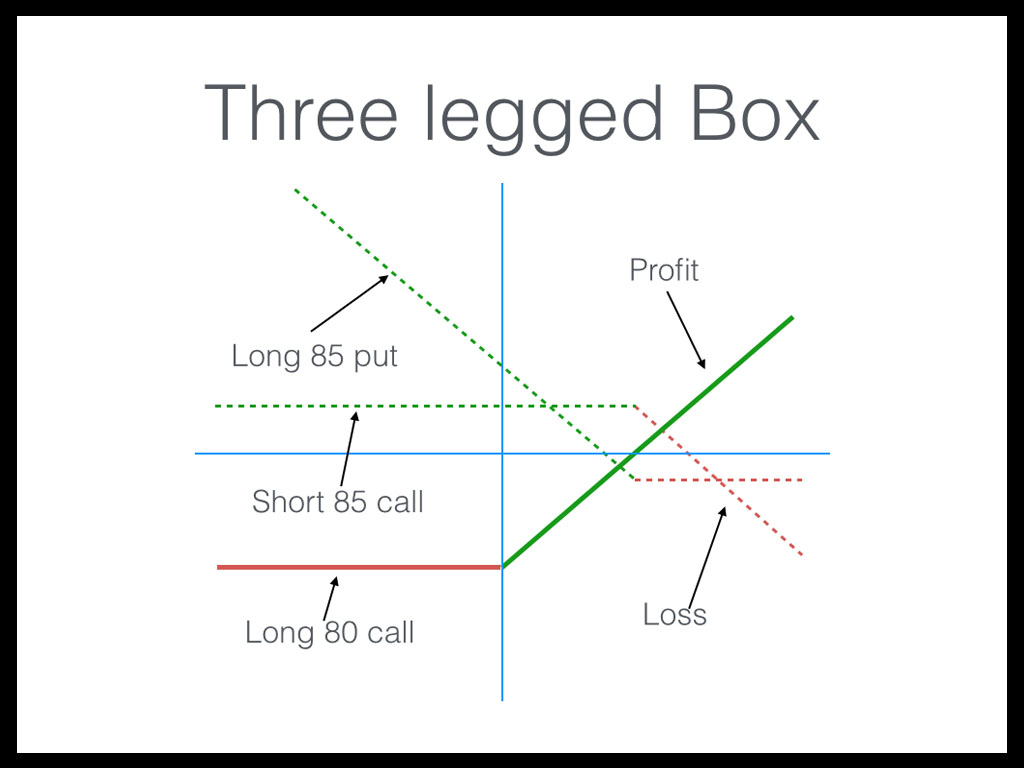

CHAPTER 2 – Three-Leg -Box

Section 1 – Typical Box Four Legs

Section 2 – The Three Leg Box

Section 3 – Practical Application

Section 4 – Three Leg Box Criteria

CHAPTER 3 – Butterflies and Condors

Section 1 – Logic Behind a Butterfly Purchase

Section 2 – Risks associated with Long Short Butterfly Spreads

Section 3 – Profit and Loss Points

Section 4 – Volatility as a function of the spread’s price

Section 5 – Large Butterfly Spreads

Section 6 – Selling Butterfly Spreads to Open a Position

Section 7 – Butterfly Characteristics

Section 8 – Ideal Conditions for a Butterfly Spread

Section 9 – Butterfly Criteria

Section 10 – (Iron) Condor Criteria

CHAPTER 4 – Reverse Gamma Scalping

Section 1 – Gamma Scalping Concept

Section 2 – Reverse Gamma Scalping Concept

Section 3 – Reverse Gamma Scalping in Action

Section 4 – More Reverse Gamma Scalping

Section 5 – Reverse Gamma Scalping Method #1

Section 6 – Case Study The SPX

Section 7 – Reverse Gamma Scalping Criteria

CHAPTER 5 – Iron Cockroach

Section 1 – Iron Cockroach Example #1

Section 2 – Analysis of Example#1 at Expiration

Section 3 – Iron Cockroach Example #2

Section 4 – Iron Cockroach Criteria

CHAPTER 6 – Portfolio Management

Section 1 – Practical Application

Section 2 – Managing the Greeks: An Overview

Section 3 – Understanding Your Positions

Section 4 – Portfolio Management Conclusion

CHAPTER 7 – Money Management

Section 1 – Money Management Recommendations

Section 2 – Risk Management Recommendations

Section 3 – The Basics Of Money Management

Section 4 – Financial Categories

Section 5 – 50-10 Rules

CHAPTER 8 – Which Strategy to Use

Section 1 – Long Call

Section 2 – Short Call

Section 3 – Long Put

Section 4 – Naked SHort Put

Section 5 – Long/Short Call or PUt Verticals

Section 6 – Butterfly Spreads

Section 7 – Straddles and Strangles

Section 8 – Time Spreads

Section 9 – Condors

Section 10 – Iron Condors

Section 11 – Covered Call

Section 12 – Collar

Section 13 – Dos and Don’t

Section 14 – Getting Started

Section 15 – Pre-and Post-Market Preparation

CHAPTER 9 – Crash Course

Section 1 – Market Crash: Opportunity in Disguise

Section 2 – What Happens During A Stock Market Crash?

Section 3 – Characteristics Of a Market Crash

Section 4 – How Professionals Survive a Crash

Section 5 – Education in Financial Markets

Section 6 – What Not To Do If the Market Crashes

Section 7 – What To Do If Market Crashes

Section 8 – The Crash Course Criteria

Section 9 – Portfolio Management Conclusion

Risk Reversals

Risk Reversal is simply a collar position without the [...]

How to Thrive in a Volatile Market: Black Ops Concept

"We should remember that good fortune often happens when [...]

Collars In Bearish Markets

Introduction Traditional collars are designed to [...]

The 5-Year Millionaire

The title of the program may sound overly ambitious, [...]

The Three-Leg Box

A three-leg box is simply a four-leg box amputee. [...]