“It wasn’t raining when Noah built the ark”

~ Howard Ruff

The Current Situation

The talk of the coming recession has been there for several months if not years now, but no one has prepared any of us to hit the wall this fast nor the reason being the pandemic. The unprecedented declaration of lockdowns in countries is not something we have thought of a year ago, nor the immediate effects of it.

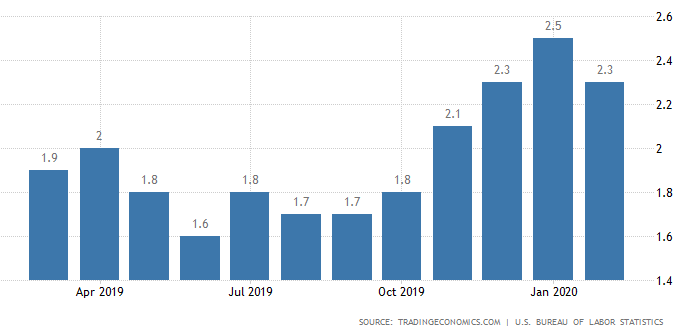

Several concerns, such as the repo issues where the government is injecting cash in the market in September, the Brexit, the inverted yield bonds, the continuing trade wars, and fed decisions on interest rates, all of these points to the upcoming recession. While most investors and traders anticipate this, who would have thought we will enter the grim situation faster than we expected it?

Most of the countries today are experiencing economic slowdown, some are now officially in recession due to Covid-19, US is no exception. Suddenly, low middle income earning employees found themselves unemployed and skimping for food. Cabdrivers, despite the threat of coronavirus couldn’t stop in fear of repossession of their taxis.

Small and medium enterprises are laying off and closing their businesses. Just in the past four (4) weeks, nearly 17 million filed for unemployment benefits with 6.6M just last week, according to the Labor Department. America has not experienced this since the last Great Depression. How to end it swiftly is a real challenge for the government. The data is beyond our imagination weeks ago, even the layoff rally after the last recession, which lasted for two years barely compare to half of the mounting unemployment figures in just a month.

According to Kathy Bostjancic, chief US financial economist, “the economy as a whole has fallen into some sudden black hole.“

Princeton University economist Alan Blinder said “This looks likely to be deep enough to qualify as a depression.”

The stock market is in limbo. It started falling fast in February 2020 and continued going down in March; it, however, bounced back when the Fed Reserve announced it was bold plans last Thursday. It announced that it will be cutting interest rates by a full percentage point and will inject large sums of money into the economy.

.

The curious mind

Are we not curious though why the lockdown due to coronavirus impaired our economy so fast? While we know that this lockdown will indeed affect our economy, but does this have to be too soon? Is it because our economy has been stretched too thin, too brittle that at the onset of a pandemic it will suddenly just break?

A healthy economy might be able to handle the crisis a few weeks more without instant support from the govt. Individuals and businesses should have savings to last at least for a few weeks, but it appears that is not the case. One possible reason is the rising cost of living in the country. Lower interest rates cause people to buy more than they can afford. Salaries of individual people are allotted to mortgages and credit card bills with barely anything to spare for their savings. Emergencies such as this pandemic then break an individual and collectively will break an economy.

Are we running out of time?

As the quote above, we should be prepared even before there is a storm. Even ants are preparing for the rainy season during summer. Right now, we are already in the middle of the storm, and it’s just starting. What portfolios do you have? Most of the people are lucky enough when they have savings in cash, as we all know, most Americans are in debt in one way or another. House and car mortgages, credit cards, etc.

But even savings in cash may not be enough when the dark times come. High cost of living is an indication that traditional money is losing its value. Whatever cash you may have at the moment may not even get you through in a month.

If you have an options portfolio then you are in a better position if you know how to play during these market swings. Randomwalk had anticipated more than a year ago that people may experience market crash, and as our way of helping our students and other options traders, we started offering “Preparing for the Market Crash” video recording for free. We even offered our valuable book “Level 5 – Advanced Option Trading Manual on How to Thrive in a Volatile Market eBook” for only $95.00 to help educate and prepare options traders early on what to do when markets became volatile. For options traders, it would be better if we use our time on quarantine by reading options books that will expand our knowledge and help us be more prepared. Here at Randomwalk, our top priority is to educate so we made our ebooks available at low prices.

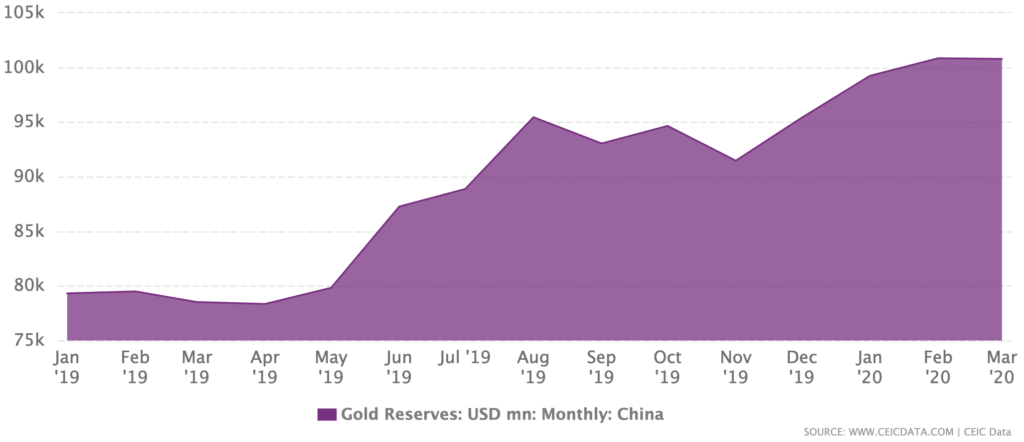

Another great form of money to possess right now is gold and silver. If you have a couple of either of the two or even both, then you are more prepared than most of the Americans. Both silver and gold don’t loose their value, in our article, Gold: The Most Stable Currency to Hold, we pointed out that both China and Central banks are in a hurry to stack up gold. For sure, they have a reason to do so. Below is an update of China’s gold reserve:

In the above chart from CEICDATA, we can see that their gold reserve continued to rise even when they experienced COVID-19 in the last quarter of 2019 up to the first quarter of 2020.

Central banks as a whole also continued their rally to buy gold reserves even up to February, while it slowed down a bit as compared to last year’s buying spree, a 33% increase from January indicated that they have not stopped buying. In the last 50 years, 2018 and 2019 are the years with the highest purchases of Central Banks, 656.2 tons, and 650.3 tons. There could be several possible reasons for this:

- Devaluation of dollars – Central banks could dump dollars due to Fed’s continuous quantitative easing. Even the current issue could be a significant factor to the devaluation of dollars.

- Geopolitical instability

- Extraordinary loose monitary policy

If Central Banks across the world are stockpiling gold reserves again, then we must be on the alert and we may want to add Gold into our portfolio.

Lastly, bitcoin and other cryptocurrencies. Many are still speculative in adding cryptocurrencies into their portfolio, but hey, bitcoin has been around for more than 10 years now and while it’s price went up and down, it hasn’t gone down to zero. It is now more stable even in the middle of a pandemic. If you want to get more educated, read our e-book, 2020 Cryptocurrency Portfolio. It will not just make you familiarize with the cryptocurrencies, it will even guide you if you decided to own a crypto portfolio.

We are now in the middle of a pandemic, a lot is happening right now not just in the US but around the world. There is so much uncertainty in the dollar stability, and it is better if we hold more than only the dollar, but the biggest investment we could gain right now while in a lockdown is KNOWLEDGE, so READ. Not just anything but books and articles that will help us gain knowledge on where to invest more, on what to buy to give us more SECURITY.

There is still time…

“Learning is not attained by chance, it must be sought for with ardor and attended to with diligence.”

~ Abigail Adams