Definition

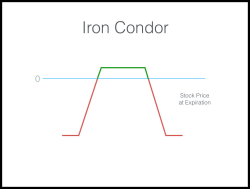

An “iron condor” is the simultaneous sale of a call vertical spread and a put vertical spread, usually when both verticals are out-of-the-money).

Purpose

When selling an OTM put vertical, one would like to see the underlying remain stable or increase in value. When selling an OTM call vertical spread, one would like to see the underlying remain stable or decrease in value. When selling an OTM call and put vertical, one would like to see the underlying remain stable. The seller of both vertical spreads is betting that by having a stable stock, both vertical spreads will expire worthless (OTM) and he will keep the totality of premiums received at the time of sale.

Iron condor spreads are an excellent alternative to selling a straddle (or strangle), or are good tools to implement when one would like to buy a condor spread, but would like an alternative method of construction.