Butterfly Spread

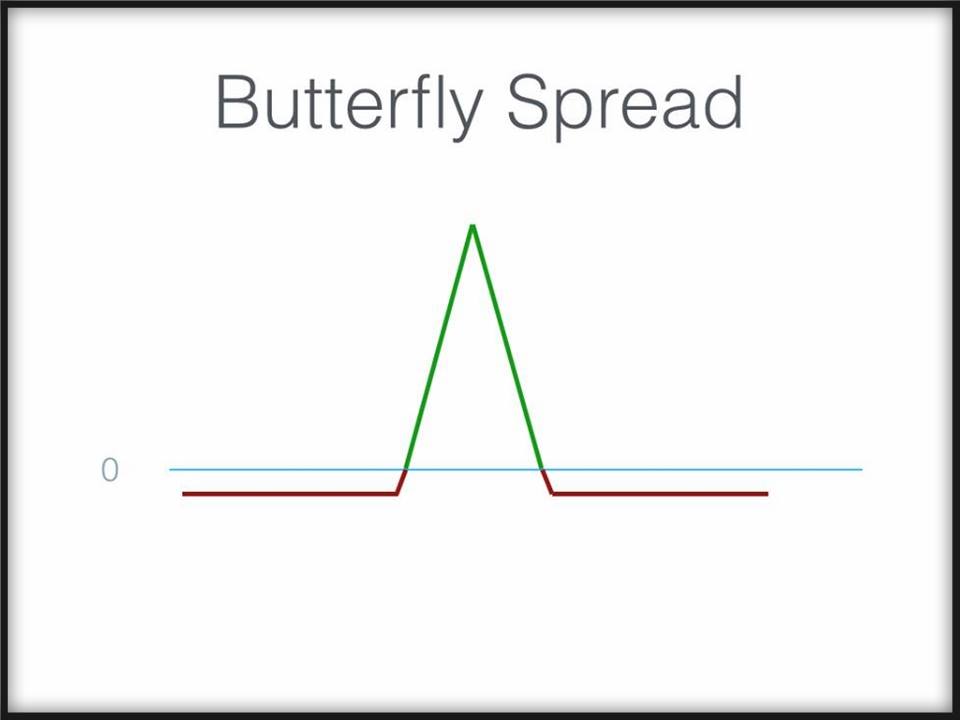

A butterfly spread is the simultaneous purchase of one vertical spread and the sale of another vertical spread with both spreads sharing a common strike; having equal spread quantities; having the same series (calls or puts); and having the same expiration date.

Limited Profit

Maximum Profit = Distance between the strike prices of the vertical spreads minus the purchase price

Maxium Value = Stock price closing between the two vertical spreads on expiration

Limited Loss

Maximum Loss = Amount Paid for the Spread

Break-Even Points

2 break-even points

The lower strike plus premium and the higher strike minus premium.

Quiz

If you buy 100-105-110 call butterfly for $ 0.20 debit.

- What is the maxium profit of this butterfly spread?

- What is the maxium loss of this butterfly trade?

- What will you see the maxium value of butterfly

- What is the break-even points?

Answer

- Maximum Profit is $ 4.80 Distance between strikes $5 – Purchase price $0.20= $4.8

- Maximum Loss is $20 per contract

- Maximum Profit only happen on expiration.

- Break even points are 100.20 ( 100 strike +0.20) and 109.80 ( 110 strike -0.20)