Interactive Live Trading Sessions

Format

Market overview

Finding New trades

Adjustment of trades.

-

Finding trades with consideration of Risk -Reward Ratio, Volatility, Hedging

-

Opening position may be a simple Vertical Put Spread, Call Spread then adding complimentary positions to increase profitability or reduce risks.

-

The art of adjusting trades are the difference between a good trader and a great trader.

Tuesday Session Sample

Sample :Trade 25D: SPX 8JUN Bullish Risk Reversal

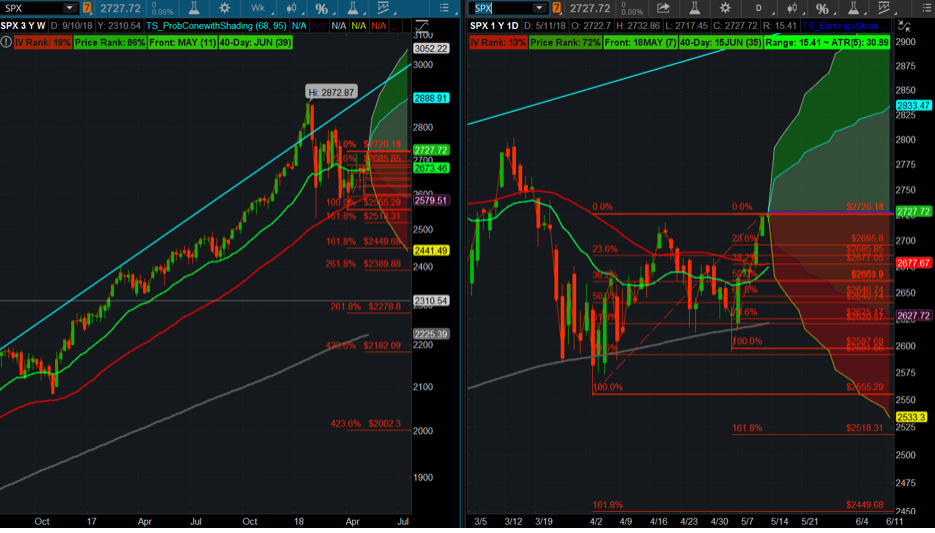

May 11, 2018

[5.11.18 Friday]

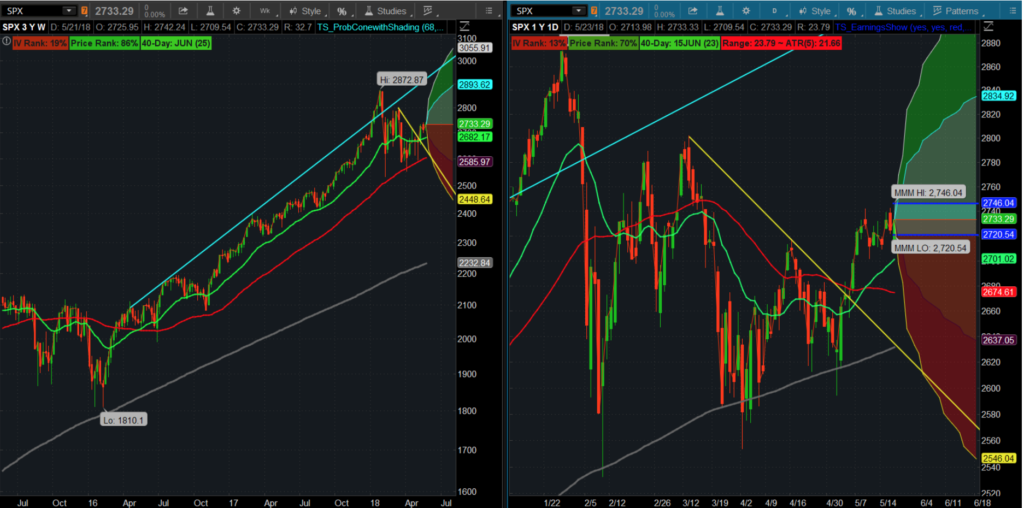

Market Overview

[5.11.18 Friday]

Last night we looked at a slightly bullish risk reversal and got filled on the put and call side today.

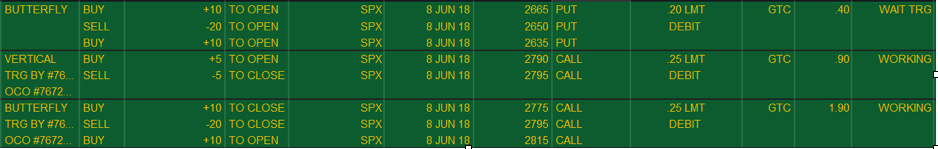

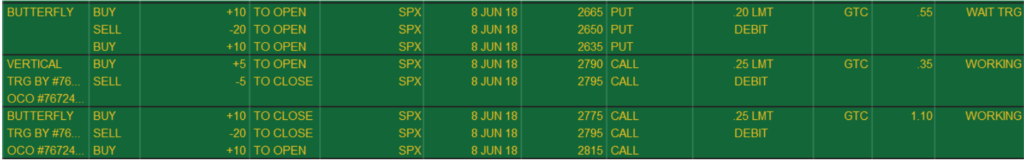

And our open orders that we discussed Thursday night are:

[5.18.18 Friday]

The SPX slowly churned higher this week forming a handle on the cup and handle pattern formation. No fills today

[5.18.18 Friday]

Our Position

[5.18.18 Friday]

Our Open Orders

[5.23.18 Wednesday]

The SPX pulled back this morning triggering one of the orders in the call OCO setup; specifically the .25 call vertical.

[5.23.18 Wednesday]

Now we have a no margin on the upside, more upside profit area and higher probability trade setup

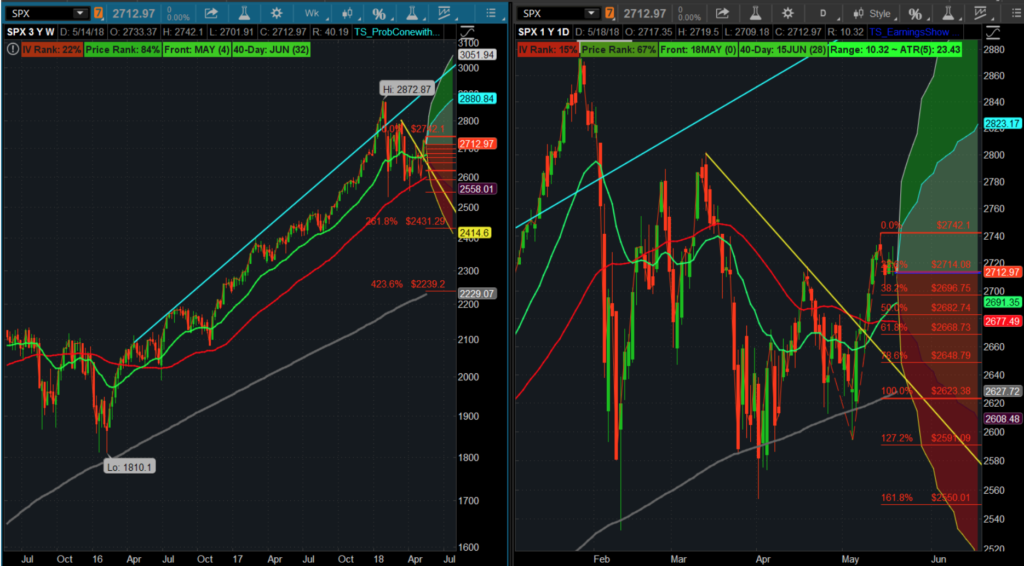

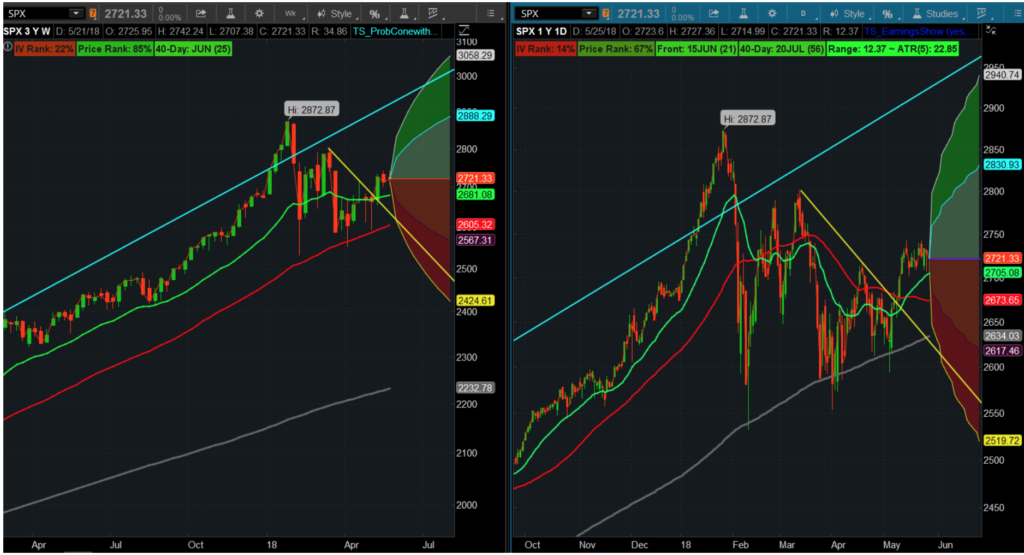

[5.28.18 Friday]

The SPX has not made a definitive move this week before the Memorial day weekend. Markets are closed Monday and we will have to wait till Tuesday to see if we can break out of this chop. No fills today

[5.28.18 Friday]

Our Position

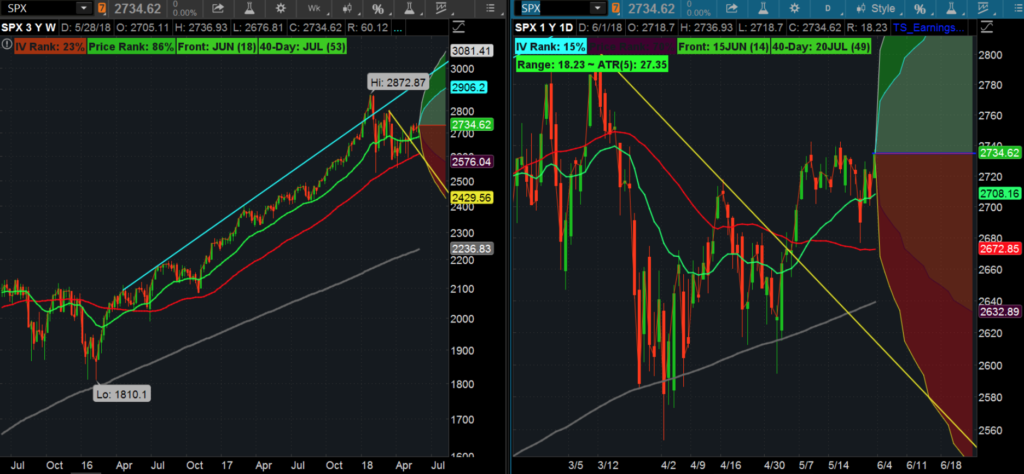

[6.1.18 Friday]

The SPX pulled back then jumped higher on the employment report. No fills today.

[6.1.18 Friday]

Our Position

[6.6.18 Wednesday]

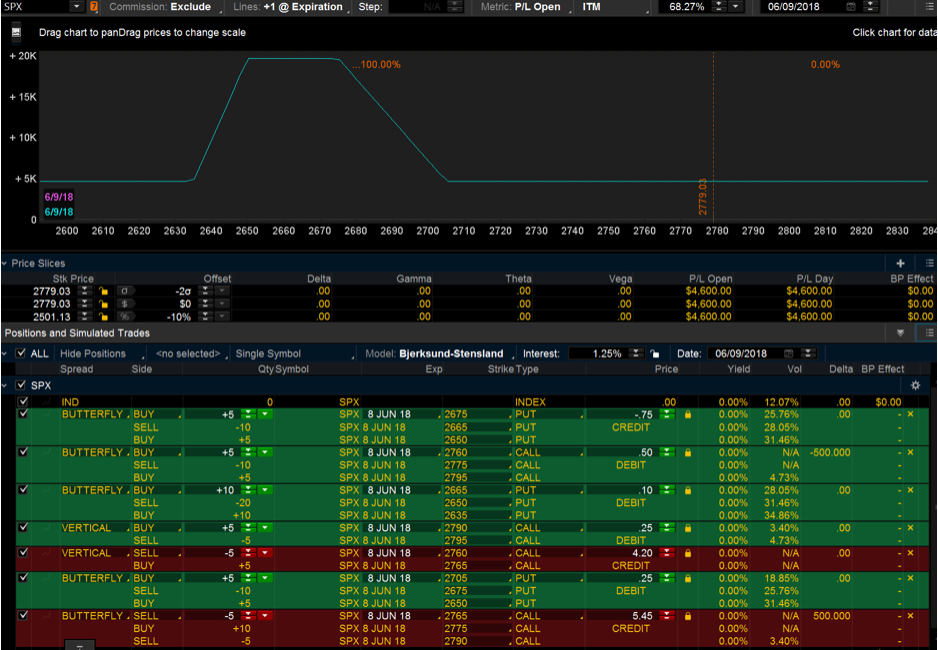

From last nights class we talked about buying a put fly to eliminate the downside risk and was considered a lottery ticket for .25 x 5 or $125 debit. Today we got filled on the put fly for .25. We also entered an order to sell the 2760/2765 call spread since it was ITM at $4.20 credit

[6.7.18 Thursday] The SPX churned higher albeit struggling but enough to get the 2760/2765 call spread filled at 4.20 x 5 or $2,100 total credit. With one day remaining and Ed heading on vacation we will enter an order to exit the call fly at 5.00 credit x 5. Ed will monitor it before lunchtime Friday and adjust higher or lower depending on what the market gives us.

[6.8.18 Friday] The SPX was down in the morning and starting churning higher by lunchtime. The call order was modified to 5.45 and got filled to collect $2,725 total credit. By market close we almost nailed the short strike at 2775 but no banana. That’s the fun.

So overall

ROI = $4,600 / $2,600 = +176%