Those familiar with gamma scalping can infer what the term “reverse gamma scalping’ means, but we will have a brief review of forward gamma scalping to better understand reverse gamma scalping (RGS).

Recall from your reading in the text Option Greeks for Profit that gamma scalping is an attempt to adjust the deltas in a long options position so that the trader can overcome the effects of time decay. With enough movement in the underlying instrument, the trader can buy and sell stock around his position making a profit much greater than the detrimental effect from time decay (theta). An increase in implied volatilities will be an even greater benefit, whereas a decrease in implied volatilities can threaten to wipe out our profits.

In short, long gamma scalping in a garden variety example consists of long straddles. When the market moves, the options’ long gamma (recall that long calls and puts both have long gamma) will force the position’s delta to change. As the market increases, the position will gain long deltas and the reverse happens when the market declines.

RGS Definition

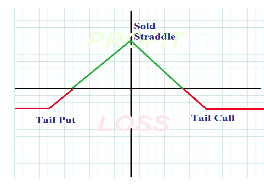

Reverse gamma scalping is the opposite of long gamma scalping, and it is usually implemented by traders who want to sell options since they believe implied volatility levels will decline. Because selling a straddle has inherent risk, many traders set limits on the trade and how much they are willing to let the underlying move before they get concerned.

As the market declines, the short gamma will have the position gather long deltas. In other words, the further down the market goes, the longer your position will be getting – not something one wants in a declining market. On the flip-side, as the market advances higher, the position will be getting shorter and shorter. Eventually you will be short the equivalent of 100 shares of stock per straddle sold as the market keeps climbing. This can be costly.

One way to protect yourself is to simply buy tails, that is out-of-the-money options to protect the position. For those starting with small amounts of money, it is imperative to purchase the tails for protection because the margin can be heavy, especially if trading indexes.

But even if you purchase tails for protection, you still may want to adjust your delta by reverse gamma scalping to protect a position that you feel is getting out of control.

When to Reverse Gamma Scalp?

The obvious answer is to gamma scalp when volatility levels are high and you have reason to believe that they will decline shortly. A decline in volatility levels will usually only happen when the market advances or stabilizes.

But What if the Market Keeps Selling Off?

This is the tough time in being short straddles because further declines in the market will usually be accompanied by an increase in volatility which incurs likely losses to the position. But picking the ideal time to enter into a short straddle is easier said than done. You must determine when a bounce is likely to occur in the markets, but remember that you will rarely ever hit the nail on the head. You will have to be prepared to have an exit point should the market continue to decline past a level you set.

If Wrong – Market Continues Down

If the market declines well beyond your comfort levels, selling stock or futures to keep your delta in line will only be a partial help. The increasing volatility levels will cause more loss to the position than the delta accumulation.

Taking off a position at a loss is difficult but the loss will likely continue to grow. In addition, you can always put the trade back on for a better price later. Discipline is the key to staying alive financially.

Market Advances

This is the ideal situation. A healthy bounce off a bottom in a stock or future will have the option traders all rushing in to sell out their long option positions for top dollar. The flooding of sell orders (for both calls and puts) will have the option’s volatility levels collapse. Recall from Option Greeks for Profit that vega can be much more powerful than delta. You may be concerned by a strong bounce and how a loss may occur because of the short calls in position, but we will touch on this in a bit.

Market Stagnates – Gyrates

This is a good situation, though volatility levels will usually not come in anywhere near as fast as if the market bounced hard. Should the market liberally gyrate, you will likely want to keep your stock purchase and sell points very wide so that you don’t end up selling bottoms and buying tops often. We will cover more on this in a bit.

Conclusion

When practicing reverse gamma scalping, there are some tricks that we learned over the years that will help you stay safer.

- We saw how old numbers could affect the expected deltas which left us unexpectedly unprotected. When on the trading floor, most traders would get the actual deltas, gammas, etc. for the next day if time was less than 2 weeks from expiration. This allows you to know you will be hedged overnight based on what the market will look like on the following morning’s opening.

- As mentioned in the text Option Greeks for Profit, one can use options instead of shares to hedge. This is important for those with tighter margin restrictions. If you are confused or you forgot how this process works, simply go back to your blue book.

- Do I keep short deltas even in a bullish market? You want to keep the short deltas on even if the market is going up, but the danger is not on the bullish side. The collapse in volatility should more than offset any loss due to having a short delta in a bullish market.

Correct Short Delta Quantity

- How many short deltas is the right amount? There is as very scientific way of calculating this estimate, but it requires too much work. When the markets are zipping around, no trader we have ever seen pulls out a calculator and starts doing tricky math. Here is a shortcut:

- Find the range in the stock and find the range in volatility over a of couple months. You can also do this for a year’s time simply to have a second number which can then be averaged with the first.

- Divide the range in the volatility (as measured in percent) by the dollar range in the stock. Suppose over 2 months that the stock had a $20 range and the volatility ranged from 60% to 70%, or 10% range. The math looks as follows: 10 / 20 = 0.50

- This means that for every dollar move in the stock you can expect volatility on AVERAGE (and very generally speaking) to increase or decrease by 0.50% points.

- Find the vega for the straddle by adding both the call and put vega together. In the IBM example above, the vega on the call was 0.09 and the vega on the put was the same. This gave a total straddle vega of 0.18. On 10 straddles this works out to be $180 (10 straddles X 100 shares per contract X 0.18).

- Multiply step 2 (0.50) by step 4 (180) to get a total of 90 shares. This is the number of shares that you want to be short at a maximum.

- In addition, you will never want to have your delta greater than 2 times your gamma. This is done to avoid letting the position run away from you.

- Because the maximum short delta came out to be 90, but our gamma in the previous example was 40, we don’t want to exceed 80 shares (gamma of 40 X 2 = 80). Keep in mind that trading stock in shares not equal to 100 even increments is a hassle and you are better off simply rounding up or down (because of price and liquidity). Step 6 and 7 are primarily for those trading very large positions.

The above steps are simply a down and dirty guide that will help protect against increases in volatility under some scenarios. Obviously no market is perfect or acts like it has in the past. Often volatility will drastically increase and deflate at certain psychological levels, so use some common sense.