Today

Economic Numbers

Market Focus »

Weekly Bill Settlement

Jobless Claims 8:30 AM ET

Philadelphia Fed Business Outlook Survey 8:30 AM ET

FHFA House Price Index 9:00 AM ET

Bloomberg Consumer Comfort Index 9:45 AM ET

Leading Indicators 10:00 AM ET

EIA Natural Gas Report 10:30 AM ET

3-Month Bill Announcement 11:00 AM ET

6-Month Bill Announcement 11:00 AM ET

2-Yr FRN Note Announcement 11:00 AM ET

2-Yr Note Announcement 11:00 AM ET

5-Yr Note Announcement 11:00 AM ET

7-Yr Note Announcement 11:00 AM ET

10-Yr TIPS Auction 1:00 PM ET

Fed Balance Sheet 4:30 PM ET

Money Supply 4:30 PM ET

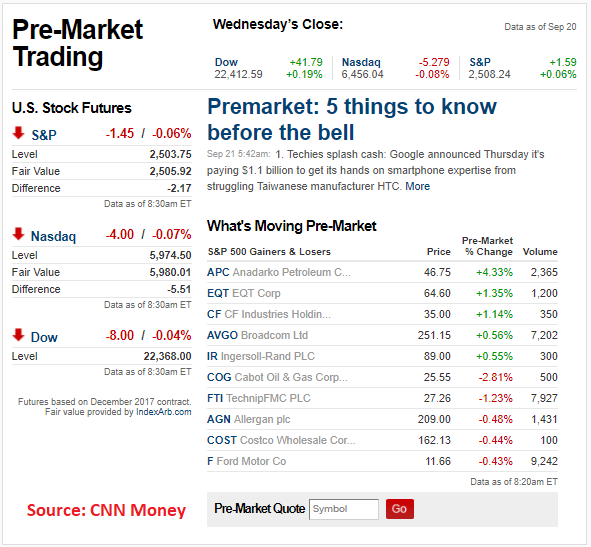

The Federal Open Market Committee announced that they are now implementing actions that would drastically lower down liquidity in the market. The European Central Bank may take the same action soon. As we all know, abundant liquidity in the market is the main cause of global asset rallies. With the continuous supply of liquidity, made possible by the central bank, overvalued markets will continue to increase in price.

With liquidity drying out, could this be start of the most anticipated crash? Thomas Kee Jr., founder of Stock Traders Daily, compared what’s happening at the moment to the story of “The Boy Who Cried Wolf.” For the longest time, we’ve been hearing warnings that the next market crash would happen soon. But after more than 5 years of preparing for it, after numerous warnings, we are still waiting for it to happen.

Article of the Week (How to Protect your Money)

The higher the markets climb, the more investors worry about the impending and inevitable correction that always ensues. Trees don’t grow to the sky, as they say, and the one thing that is guaranteed in this world is that the market will crash again. You cannot accurately predict when the market is going to crash, so getting out too early usually results in missed gains. Yet one is not helpless to the receding tide of equity prices; you can augment a new or existing equity position to sustain value in a correction. And though hedging a position can get complex, the more remedial positions are fairly easy to understand after learning not much beyond the option basics.

DISCLAIMER (Seriously!)

Trading is almost as much fun as black jack in Vegas, but without all the annoying distractions of free drinks, Broadway shows, gorgeous people with low morals, and free buffets. It also has about the same odds of success, so when you lose all your money you wont have to walk past a smiling pit boss. Even Bruce Wayne lost everything with options in The Dark Knight Rises, and Superman keeps his day job at the Daily Planet newspaper.

We have the utmost respect for our attorneys who tell us any attempt to trade is throwing money out the window, and investing is risky business (still a great movie). Past performance doesn’t mean a thing. The future is even scarier. Random Walk and everyone associated with it promises absolutely nothing. We guarantee nothing. We wont ever do anything right unless it is an accident.

Random Walk only provides education (and a great cup of Starbucks if you visit our office). If you want advice please consult an attorney, licensed broker, Joe Kearnan, tax consultant, investment adviser, etc. Random Walk, LLC is full of morons, dolts, has-been(s), chromosome damaged individuals, thieves, losers, and carnival barkers. Any attempt to find a semblance of intelligence or integrity in Random Walk would be a waste of time. We will sell products, but advise against buying them. We Do Not Give Advice.

When reading this you acknowledge that you agree to hold harmless Random Walk, LLC, its employees, independent contractors, authors, managers, owner(s), spouses, children, cousins, friends, bail bondsmen, and favorite bartender. In fact, you agree to grow up, accept some responsibility for your own actions, and stop believing the media that sells you on how nothing is your fault. You further agree in the antiquated and lost values that America is the land of opportunity and not the land of handouts. You agree any loss in the markets is a result of your own actions as we told you NOT to trade without consulting someone other than us.

All paper trades are SOLELY for example and to illustrate how certain strategies could perform without the benefit of hindsight and back-testing. You agree NOT to trade based on anything we say, do, write, advertise, etc. If we were smart we would be teaching high-school math and making the really big bucks. You agree to abide by the laws of your country and that it is legal to accept this transmission.

Every attempt has been made to ensure accuracy, but we are clueless. As a result it would be foolish and impossible to assure the accuracy of any numbers and/or come close to writing a sentence that is grammatically correct. You agree not to get on our case emotionally, physically, spiritually (no Voodoo dolls please) or legally when we screw up. We are doing our best to keep up with evolution, but it is a fast race and we are falling behind. If any of this stuff is too hard to accept please let us know and we will remove you from our mailing list and short term memory.

Random Walk deeply cares about each and every student. We try to keep the selling of products to a minimum. We believe our students are a result of attraction rather than promotion. This does NOT mean that the more attractive you are, the more we promote ourselves (in general).

Our products are written ONLY by floor traders, fund managers and retired floor traders. But that really doesn’t mean much. They are expensive and unique. That does NOT mean they (materials) come on a tablet of concrete from Mt. Sinai. . If you are still reading this, you will likely be the first to have gotten this far. No guarantee for accuracy is made. Nothing we do is audited and we make no promise of accuracy.

Because of the proprietary nature of our materials and the ease of electronic copying, all sales are final. There are far too many people who have no problem stealing our materials and putting them on torrents or copying them. These are the same low-life, selfish, whining, half-wit hypocrites that would cry like a newborn with a wet diaper if someone stole their car radio. They have to pay for our materials before stealing them, and live with their karma (and our legal team). Yes, we have caught a few and now have one person working on detective work solely.

Sales are far from our largest concern. If you are a whiner, complainer, or generally unhappy with life please go to someone else in this industry who values money over happiness. We can point you in the direction of other firms that only care about the bottom and top line. Jerry Springer can also point you in the right direction. Besides whiners are a total distraction from the awesome group of students we are fortunate to have. We are truly blessed and thank them (provided that is fine with our lawyers). “Thank yous” are only handed out in countries where legal and void where prohibited. If your country does not allow “thank yous” please refrain from accepting it. This disclaimer is copyright material and not a joke.