Random Walk Trading.com

Wednesday

January 28, 2015

1-855-RWT-0008

Prepared by the good people at Random Walk, LLC.

___ ___ ___ ___ ____

Closing Prices From Yesterday

Company News

Two seats left of Vegas session – Feb 19-21

The year-end book for “POT – A Year in Review” went to the printers today

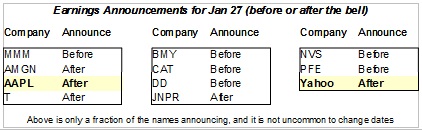

EARNINGS

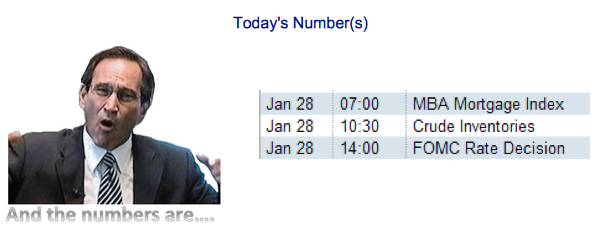

POT Class Tonight and Fed Rate Decision at 2:00pm eastern

Yesterday and Today

Yesterday

Sunday night/Monday morning

The day started well before the market opened with the Greek elections scaring all of Europe, and the shock wave making it across the pond to the US. The E-minis were down -$15, the Euro was below e1.12, and bonds were getting bought up in a flight to safety. All this indicated we would have a rocky start, and we almost did.

Pre-Open

When it came time for the US markets to open it appeared they were going to be marginally lower, but nothing like earlier at night. The stupidity of Greece’s elections sort of ran its course faster than normal. As a matter of fact yesterday’s update was a warning to not take it serious despite the fact that the market was going to open lower.

Open

On the open the E-minis were unchanged but started to fall seconds after the bell. The Dow, SPX, etc went with it. The Dow was down over 100 points right out of the shoot, but they then started to limp their way back up.

Trading Day

The trading day was spent mostly with the Dow, SPX, and NDX vacillating around the break-even point. It really was a normal trading day compared to what we saw for the first three weeks of the year, further strengthening my belief that the ugly January market is in the past. Please keep in mind that last year’s ugly January market ran through the middle/end of February before calming down, therefore we are doing a lot better this year (so far).

And that is how things looked until the end of the day – a coin flip on if we would be higher or lower on the bell.

Last Minute

The last few minutes of trading saw $300 million in ‘buy programs” on the bell driving the markets to the “tails” side of the coin, thus a positive close. What is interesting is that the buy program momentum kept the E-minis running after 4:00pm. From 4:00pm – 4:15pm the E-minis ran up another $5 points, or about 50 Dow points. Those Dow points are not factored into the closing price since stocks had closed.

After the Bell

After the close a couple of stocks reported their earnings (MSFT, STX, TXN, RMBS, UTX, etc.) most notably MSFT. Microsoft will likely open lower by a few percent after its commercial sales numbers fell. Of all the tech companies reporting yesterday everyone (I saw) fell after earnings.

TODAY

Based on how the Dow closed and then the E-minis kept running higher we will see a slight disconnect from the Dow and the SPX all day tomorrow until things get back into line. It is as if the two are always in a race where they are about dead-even in results most of the time, but today the E-minis got a head start.

BULLISH CASE

What is bullish looking forward is that the E-minis are only down 1.25 at 11:15 eastern. They ran up $5 after stocks closed, so either stocks have to meet the E-minis or the E-minis fall back to stock levels. In addition oil is unchanged, the Euro is up pretty decently, Russia is in the news again, and tech earnings disappointed after the close.

With the four or five quick jabs to the face the market is still holding up, and that is bullish.

BEARISH CASE

We are seemingly always having something attack the bull. If it is not government shutdowns, Syria news, terrorist attacks, another law against business (after all you didn’t build your business, remember that speech? Your business is only needed to provide campaign contributions), oil falling, ending of QE, weak economies of Europe and China, oil falling even more, Switzerland pulling its currency peg off of the Euro, and now Greece (again, and again), this could be just more sticks being thrown on the camel’s back in a fragile recovery.

CLOSING:

Today’s initial tone likely will be set by companies reporting before the bell. In addition….we will see how the media portrays snow falling as something that will ruin the economy (as if we have not had acts of God before). Be careful of small liquidity today if the snow pans out as bad as the media is claiming. I find my weather rock is more accurate

.

POT is held each Wednesday night at 7:00pm eastern.

SCHEDULE

More on hedging a long vertical spread (going for or against you)

-

-

Using the E-mini options as a hedge against the SPX and/OR a portfolio of stocks to enable a trader to be able to hedge 23.5 hours a day.

-Convoluted Spread in PCL/TSLA middle of Feb.

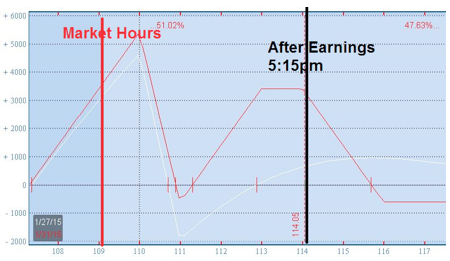

As has been the case with everything in the market for January I have no idea what is going to happen. I wish the Dow was down yesterday so I could get bullish, but it is just a water torture of volatility. That is why the game plan for the month has been to just keep lopping condors, risk reversals, etc. on top of one another. We added more to AAPL today and at 5:15pm eastern the stock climbed from a close of 109 to 114. We hit a triple if the stock is there Friday night.

-

-

Contract the office at 1- 855 – RWT – 0008 for more details.

## ## ## ## ## ## ##

DISCLAIMER (Seriously!) All data above is provided for informational purposes only. Random Walk makes no guarantee as to the accuracy of the data.

Trading is almost as much fun as black jack in Vegas, but without all the annoying distractions of free drinks, Broadway shows, gorgeous people with low morals, and free buffets. It also has about the same odds of success, so when you lose all your money you wont have to walk past a smiling pit boss. Even Bruce Wayne lost everything with options in The Dark Knight Rises, and Superman keeps his day job at the Daily Planet newspaper.

We have the utmost respect for our attorneys who tell us any attempt to trade is throwing money out the window, and investing is risky business (still a great movie). Past performance doesn’t mean a thing. The future is even scarier. Random Walk and everyone associated with it promises absolutely nothing. We guarantee nothing. We wont ever do anything right unless it is an accident.

Random Walk only provides education (and a great cup of Starbucks if you visit our office). If you want advice please consult an attorney, licensed broker, Joe Kearnan, tax consultant, investment adviser, etc. Random Walk, LLC is full of morons, dolts, has-been(s), chromosome damaged individuals, thieves, losers, and carnival barkers. Any attempt to find a semblance of intelligence or integrity in Random Walk would be a waste of time. We will sell products, but advise against buying them. We Do Not Give Advice.

When reading this you acknowledge that you agree to hold harmless Random Walk, LLC, its employees, independent contractors, authors, managers, owner(s), spouses, children, cousins, friends, bail bondsmen, and favorite bartender. In fact, you agree to grow up, accept some responsibility for your own actions, and stop believing the media that sells you on how nothing is your fault. You further agree in the antiquated and lost values that America is the land of opportunity and not the land of handouts. You agree any loss in the markets is a result of your own actions as we told you NOT to trade without consulting someone other than us.

All paper trades are SOLELY for example and to illustrate how certain strategies could perform without the benefit of hindsight and back-testing. You agree NOT to trade based on anything we say, do, write, advertise, etc. If we were smart we would be teaching high-school math and making the really big bucks. You agree to abide by the laws of your country and that it is legal to accept this transmission.

Every attempt has been made to ensure accuracy, but we are clueless. As a result it would be foolish and impossible to assure the accuracy of any numbers and/or come close to writing a sentence that is grammatically correct. You agree not to get on our case emotionally, physically, spiritually (no Voodoo dolls please) or legally when we screw up. We are doing our best to keep up with evolution, but it is a fast race and we are falling behind. If any of this stuff is too hard to accept please let us know and we will remove you from our mailing list and short term memory.

Random Walk deeply cares about each and every student. We try to keep the selling of products to a minimum. We believe our students are a result of attraction rather than promotion. This does NOT mean that the more attractive you are, the more we promote ourselves (in general).

Our products are written ONLY by floor traders, fund managers and retired floor traders. But that really doesn’t mean much. They are expensive and unique. That does NOT mean they (materials) come on a tablet of concrete from Mt. Sinai. . If you are still reading this, you will likely be the first to have gotten this far. No guarantee for accuracy is made. Nothing we do is audited and we make no promise of accuracy.

Because of the proprietary nature of our materials and the ease of electronic copying, all sales are final. There are far too many people who have no problem stealing our materials and putting them on torrents or copying them. These are the same low-life, selfish, whining, half-wit hypocrites that would cry like a newborn with a wet diaper if someone stole their car radio. They have to pay for our materials before stealing them, and live with their karma (and our legal team). Yes, we have caught a few and now have one person working on detective work solely.

Sales are far from our largest concern. If you are a whiner, complainer, or generally unhappy with life please go to someone else in this industry who values money over happiness. We can point you in the direction of other firms that only care about the bottom and top line. Jerry Springer can also point you in the right direction. Besides whiners are a total distraction from the awesome group of students we are fortunate to have. We are truly blessed and thank them (provided that is fine with our lawyers). “Thank yous” are only handed out in countries where legal and void where prohibited. If your country does not allow “thank yous” please refrain from accepting it. This disclaimer is copyright material and not a joke.