Synthetics

Introduction

The first time people are introduced to synthetics the mind has a tendency to freeze up and the eyes glaze over. The fact of the matter is that they are rather easy to understand once you take the time to think through what they actually are one piece at a time. We will begin slowly and build up so as to not lose anyone.

Additionally when people first learn synthetics they often fail to see the practical applications involved, but I assure you that there are so many things that can be done with a synthetic that the time spent learning them should be financially offset. In addition, one can take a synthetic and buy/sell the real instrument against it in certain arbitrage and/or closing strategies that will potentially save you a fortune compared to simply closing out a trade.

Keep in mind that both lousy and great traders often enter into the same trade simultaneously as a result of a broker dividing a trade up evenly. Though both are in the same trade, the great trader will often use his knowledge of synthetics to find a way to scrape a little more money out of the trade than the less knowledgeable trader.

Building Blocks

There are three instruments that are used to create synthetics. The building blocks are:

- Stock (Long or short)

- Calls (Long or short)

- Puts (Long or short)

Creation

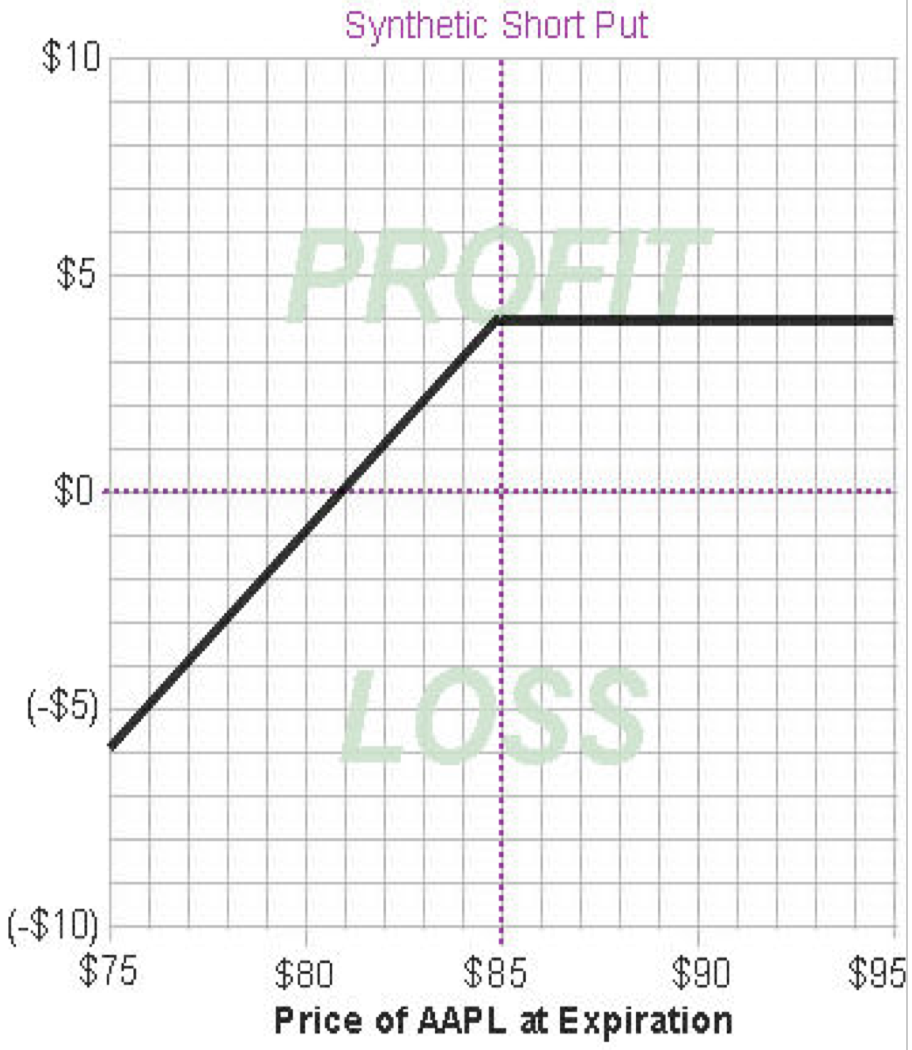

By using any two of the building blocks you create a third whether you know it or not. Many novice option traders are sold by their broker on doing a strategy known as a covered call. A covered call, as you may well know, is a long stock position where the owner sells a call against the stock position to “enhance” his returns. This is a strategy where the trader used two out of the three building blocks (Long Stock and Short Call) to create a synthetic position – a synthetic short put to be specific.

All Synthetics

The list below is the total of all synthetics which can be created. We will begin learning them by a quick building block formula, and then will proceed to prove to you that this really works via risk graphs and profit and loss charts. The synthetics are as follows:

| Block One | Block Two | Synthetic | |||

| Long Stock | + | Short Call | = | Synthetic | Short Put |

| Long Stock | + | Long Put | = | Synthetic | Long Call |

| Short Stock | + | Long Call | = | Synthetic | Long Put |

| Short Stock | + | Short Put | = | Synthetic | Short Call |

| Long Call | + | Short Put | = | Synthetic | Long Stock |

| Short Call | + | Long Put | = | Synthetic | Short Stock |

Proof That Synthetic Equals the Real

Now that you have a general overview of the building blocks, each one will be broken down further as proof that the synthetic works exactly like the actual instrument it is mimicking. In other words, each of the above synthetics is going to be broken down by logic, graphs, and profit and loss tables so that no matter you learn best, it will be covered.

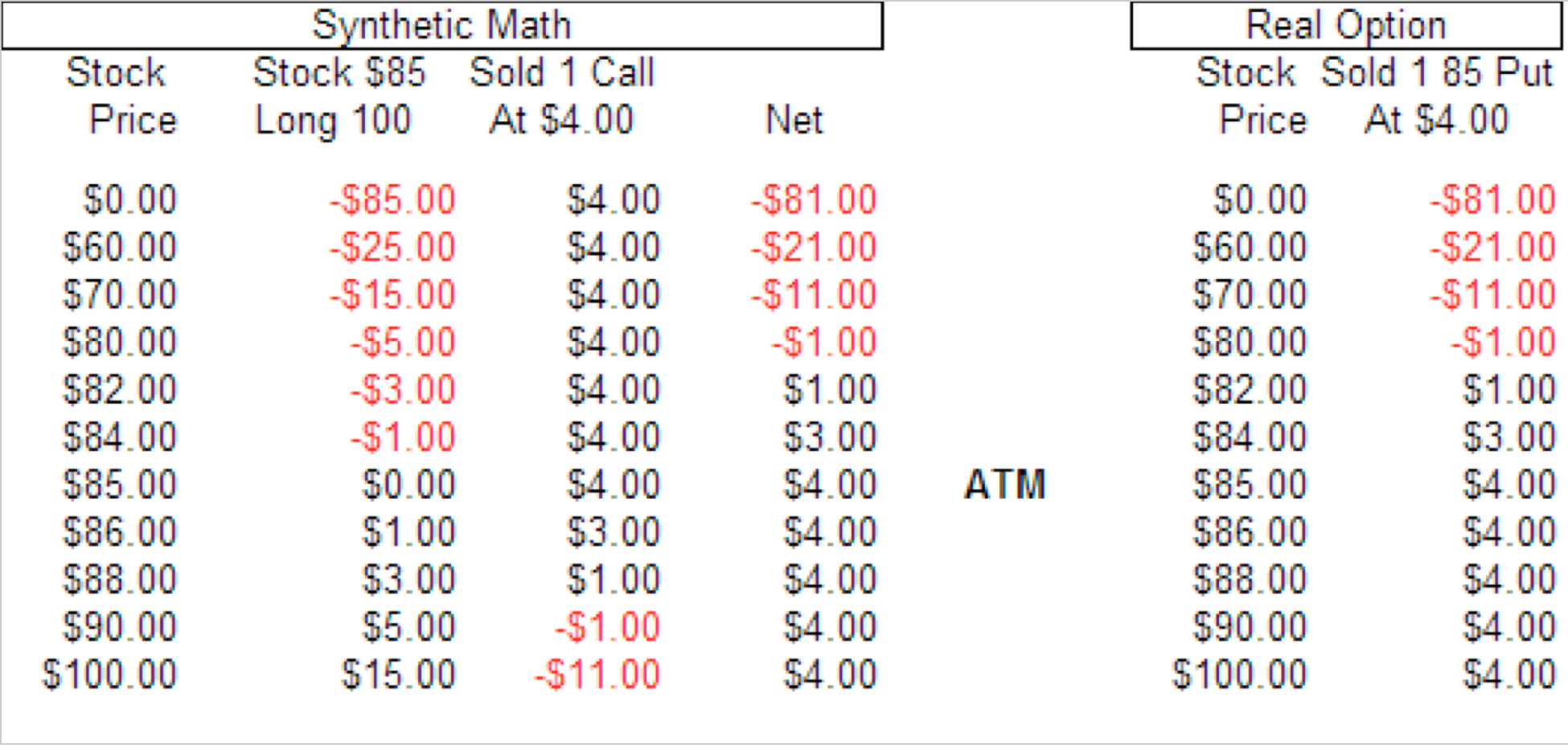

For the examples throughout this section we will use option prices from an actual equity and use the same prices throughout the section to assist in learning, to avoid confusion and to show how these really are interchangeable positions. We will also be looking at the same price (the mid price) regardless of whether we are buying or selling the instrument simply to keep the bid-ask spread (slippage) out of the equation. All prices used are as follows:

AAPL Stock = $85

AAPL 85 Call = $4

AAPL 85 Put = $4

- Synthetic Short Put = Long Stock + Short Call (SSP = LS + SC)

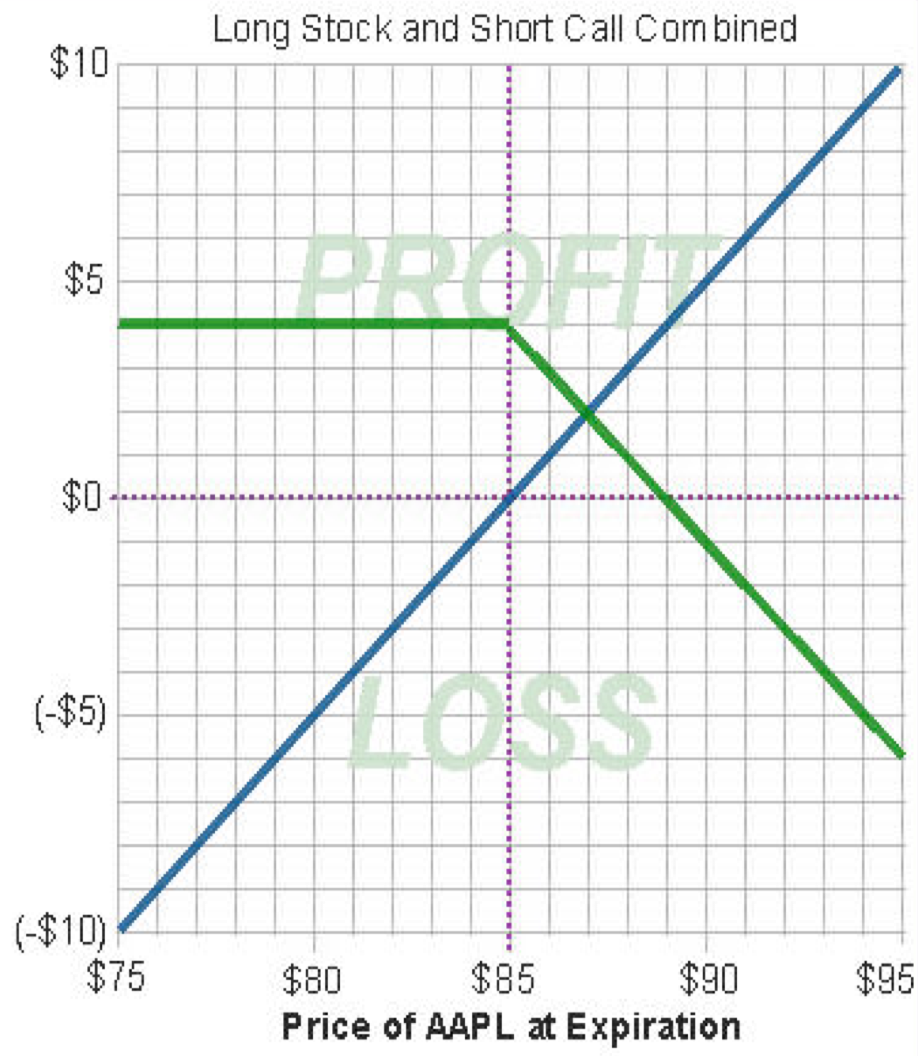

A synthetic short put can be created by adding long stock and a short call to a position. This position is known as a “covered call” and is considered by Random Walk to be a risky trade even though many brokers recommend it. These are usually the same brokers who will tell people that a naked short put is risky when in fact it is the exact same position as a covered call.

Common Sense:

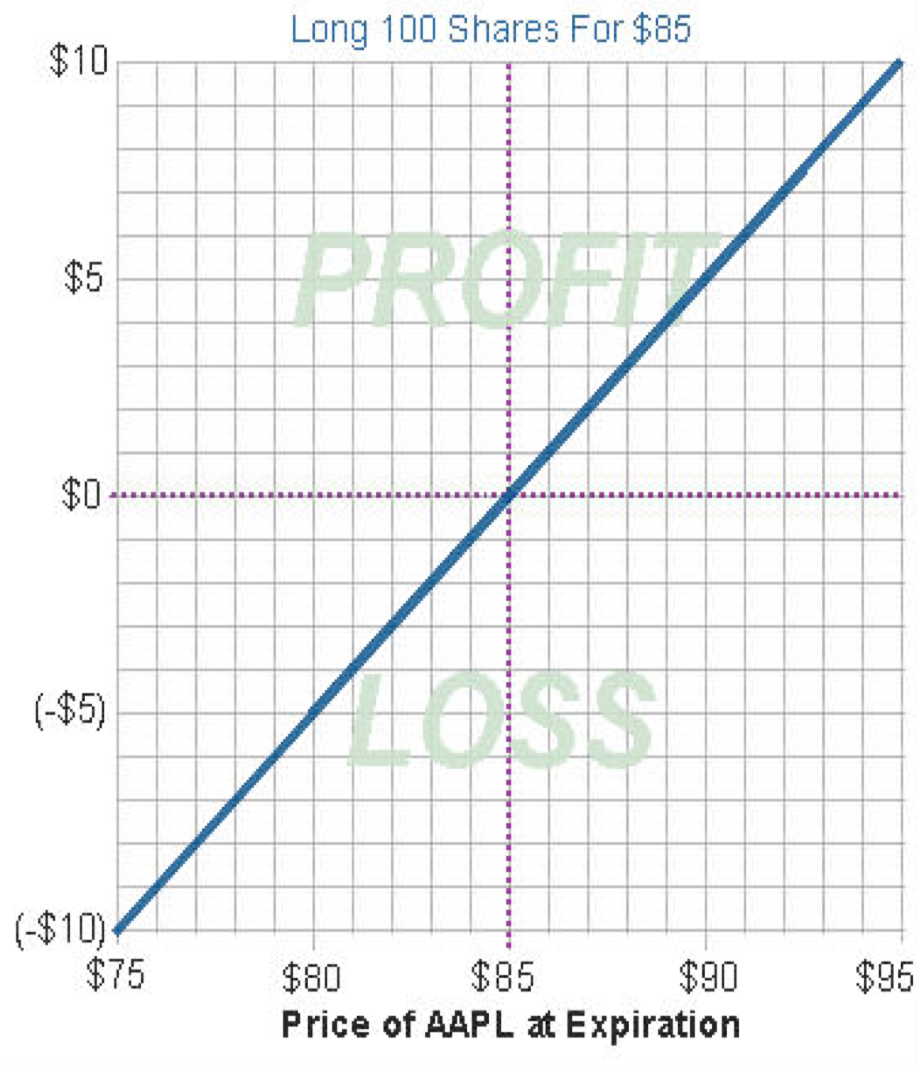

If you are long stock you can make unlimited gains to the upside but you can lose the full amount of the stock should it go to zero. The short call caps out your profit on the upside because once the stock advances past the short call strike any money made on the stock will be offset by a loss on the call that was sold short. So this would indicate that the upside is limited. On the downside a sell off in the stock will result in a loss that can only be offset by the amount taken in from the sale of the call, which is limited.

Profit and Loss Table of Synthetic Short Put

Profit and Loss Graphs

Some people obtain a better understanding viewing visual representations and pictures rather than the math. For those people, the following profit and loss tables should be of benefit.