Definition

A long strangle consists of purchasing an out-of-the-money call and an out-of-the-money put at the same expiration date. Example: Stock is at $100. Buy the January 105 call for ($1) and buy the January 95 put for $1 for a net debit of $2. This formula works regardless of the underlying’s price.

Objective

To profit from Advances or Declines in the chosen underlying at a lower cost than a straddle.

Maximum Risk

The original cost [eg $2 per spread = $200 risk ($2 per share * 100 shares per contract * 1 contract)].

Maximum Profit

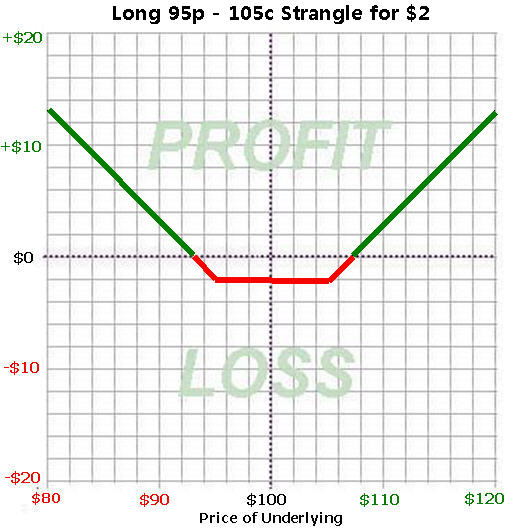

Unlimited to the upside. Limited to the lower (put) strike less the total premium paid to the downside. Strike price – minus the cost. [95-105 strangle bought for $2 = unlimited maximum profit to the upside and $93 to the downside ($95 strike – $2 original cost)].

Benefits

Strangles can become profitable strategies in the case where traders feel that a stock is about to make a large move but are not sure in which direction.

Break-even (B/E)

These are the prices the stock must get to at expiration for the trade to break-even. In a long strangle, there are TWO Break-even points. The upside break-even is equal to the higher (call) strike price plus the premium paid. The lower break-even is equal to the lower (put) strike price less the premium paid. If you bought the 95-105 strangle for $2, the B/E levels would be $93 and $107 (105 strike + $2 or 95 strike – $2).

If the stock closes at expiration between the B/E levels, a loss will occur. If the stock closes beyond either B/E on expiration a profit occurs.

Note

Even though the strangle costs less than the straddle, the trade-off is that the break-even levels are wider.

| Long Strange Profit and Loss | |||||||||

| StockPrice | Long 105 Call | + | Long 95 Put | = | Spread Value | – | Cost | = | Profit or Loss |

| 150 | $45.00 | + | $0.00 | = | $45.00 | – | $2.00 | = | $43.00 |

| 110 | $5.00 | + | $0.00 | = | $5.00 | – | $2.00 | = | $3.00 |

| 107 | $2.00 | + | $0.00 | = | $2.00 | – | $2.00 | = | $0.00 |

| 106 | $1.00 | + | $0.00 | = | $1.00 | – | $2.00 | = | ($1.00) |

| 105 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 104 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 102 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 100 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 98 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 96 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 95 | $0.00 | + | $0.00 | = | $0.00 | – | $2.00 | = | ($2.00) |

| 94 | $0.00 | + | $1.00 | = | $1.00 | – | $2.00 | = | ($1.00) |

| 90 | $0.00 | + | $5.00 | = | $5.00 | – | $2.00 | = | $3.00 |

| 80 | $0.00 | + | $15.00 | = | $15.00 | – | $2.00 | = | $13.00 |

| 50 | $0.00 | + | $45.00 | = | $45.00 | – | $2.00 | = | $43.00 |

Many have an easier time understanding strategies when looking at profit and loss graphs. The graph below shows what the Strangle looks like.