Advanced Broken-Wing Butterfly Spreads

(2009 Webinar 3, Week 6)

Broken-wing butterfly spreads are powerful trades which are a cornerstone of Random Walk Trading. We were the first company to introduce them and we continue to stress their importance. Now, there are small derivatives of this trade we would like to introduce to you as “advanced broken-wing butterflies.”

One can modify the traditional BWB with three things:

- Adjust strikes

- Adjust months

- Adjust the price of the BWB

Adjust the strikes

When implied volatility is low, initiating a BWB with your usual distance between strikes may be difficult. For example, a BWB is commonly placed in the OEX index with a strike separation $10 apart from the first buy strike and the middle sell strike. For example, say the OEX is at $400. A a $380-$370-$345 BWB with a month until expiration can easily be placed for even money or for a credit. When volatility gets very low, things change and people get eager to place a trade for monthly income and find themselves doing BWBs with less distance between the first two strikes (the closer to ATM buy strike and the center sale strike).

In addition, you can find yourself doing BWBs very wide apart when volatility goes to extreme highs. The traditional garden variety BWB is just like a normal butterfly spread, but the tail is pulled further away than even spacing. Yet, by playing with different strikes at either high and low volatility levels, you can lessen the risk of the BWB.

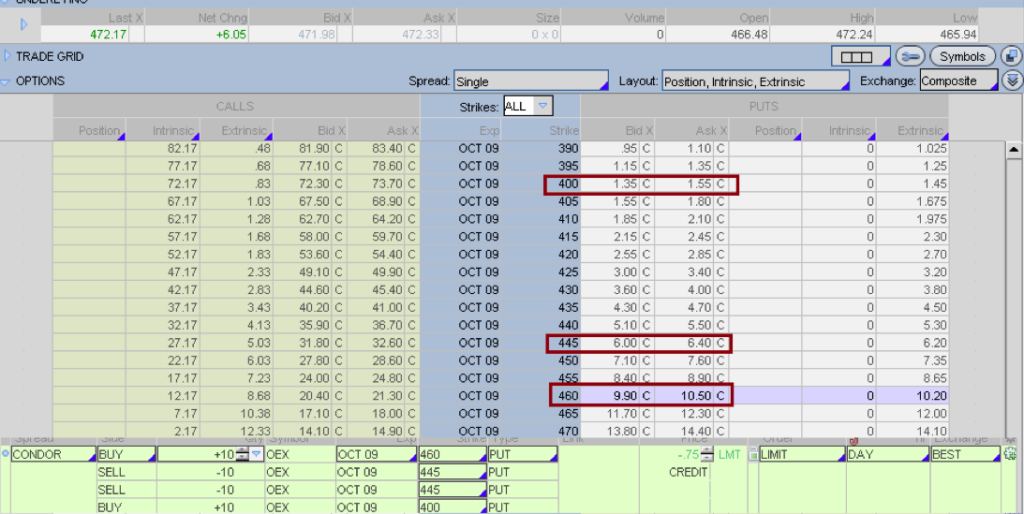

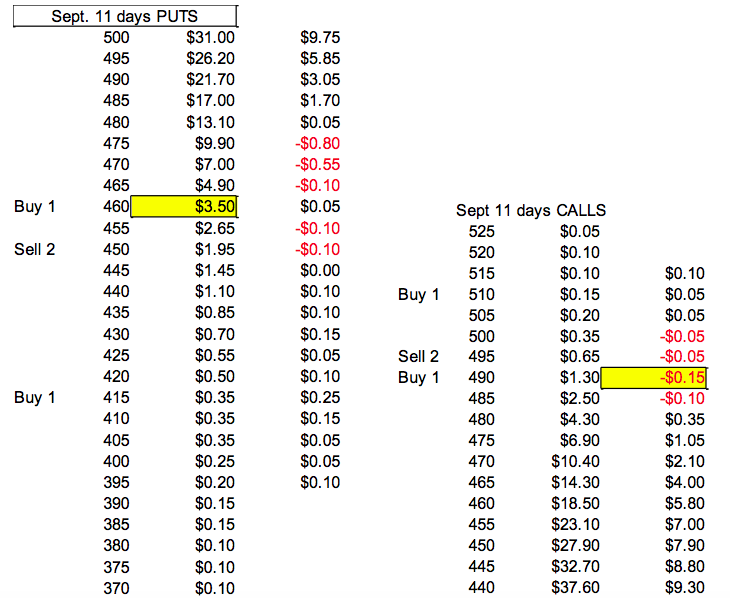

Notice below the BWB in the OEX. With 39 days until expiration and the VIX at 25%, we can do the 460-445-400 BWB for a $0.75 credit.

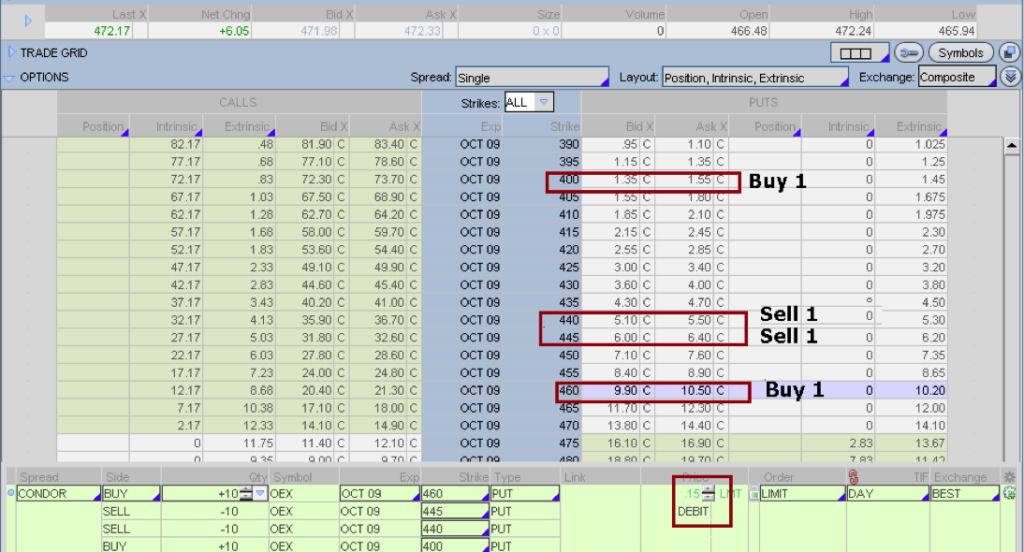

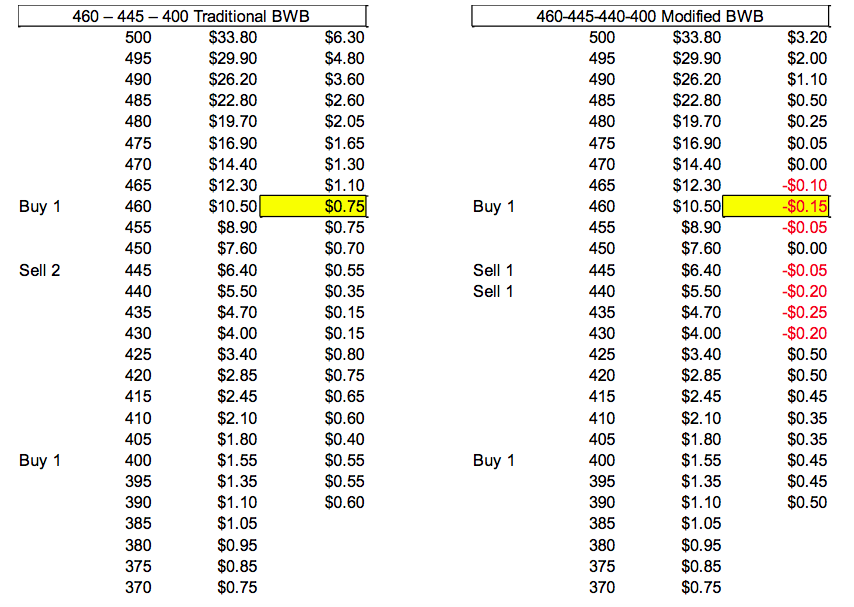

Yet, we can now do a modified BWB for a $0.15 debit by pulling one of the two center options further down. This will greatly increase our profit potential and our risk protection. A $0.75 credit may be very tempting, but look how the risk changes as we move through strikes. You will notice that the separated center strikes of the second spread hold protection against a move that is too fast.

Notice the next table. The prices moving down from the top strike demonstrate that both spreads will hold up well as the market runs higher. In other words, the 460-445-400 put BWB’s current price is represented at the 460 line. As the market moves higher, the price of the BWB changes as seen in the lower strikes. A $5 move higher in the market will make the 460-445-400 BWB look like the price at the 455 line, which is still $0.75.

With a $5 move lower in the market, things start to change. The traditional BWB moves from $0.75 to $1.10an immediate loss of $0.35. The modified BWB (on the right side of the table) moves from a $0.15 debit to a $0.10 debit a loss of only $0.05. Moving 3 strikes lower in the OEX (going up to the 475 strike line), we see things change even more dramatically. The traditional BWB that we liked for the $0.75 credit now moves to $1.65 to leave us with a $0.90 loss. The modified BWB holds up much better. It moves from a $0.15 debit to a $0.05 credit for a loss of only $0.20.

By playing with the strikes even more, we can find an even better butterfly, but this takes some practice.

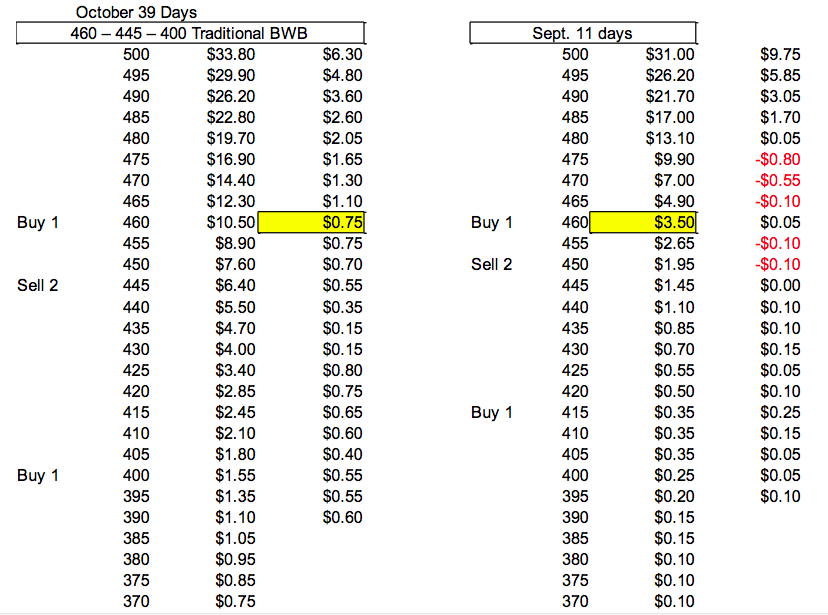

Adjust the Months

We can also compare different months to determine the best trade. For example, we have been looking at October options so far (with 39 days until expiration). We can line up the September options to the right of the October options and make a comparison. Because there is less time until expiration, we will not be able to split our strikes as wide, but we can still look at the 460-450-415 spread which can be put on for a $0.05 credit.

Notice that the spread in September holds up well to a lower move in the market. Should the market fall 3 strikes (making the same comparison as before), the 475 line will show how the spread will go to a $0.80 debit. Since we put the September spread on for a $0.05 credit, and now the spread would cost $0.80 to buy, we would actually make $0.85 on this trade. This trade holds up much better on a 3 strike move than the other two trades which were previously considered. Adjusting months in our consideration definitely pays off.

Now, you should carefully study the tables and make comparisons. Afterwards, you should practice this a few times on your own to get a good feel for BWB pricing and strike price adjustments.

Call vs Put

DISCLAIMER