Objective:

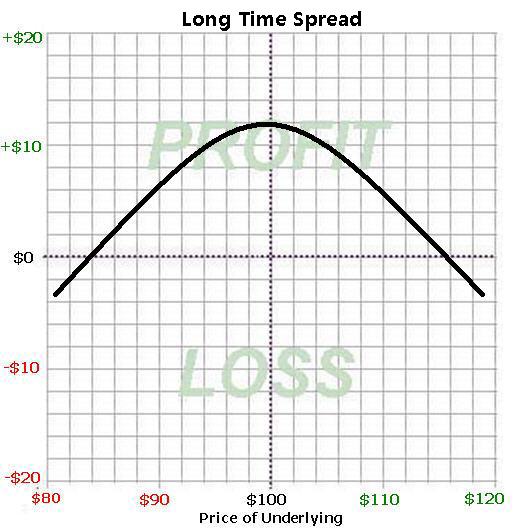

To profit from a stock that is expected to remain in a range.

Definition:

A long time spreads consists of purchasing a longer term option and selling a shorter term option at the same strike price. It can be constructed using both calls or both puts.

Example 1:

Buy the February 100 call for ($3) and sell the January 100 call at $2 for a net debit of $1.

Example 2:

Buy the February 100 put for ($3) and sell the January 100 put at $2 for a net debit of $1.

This formula works regardless of the underlying’s price.

Maximum Risk:

The original cost

Maximum Profit:

The actual levels depend heavily on implied volatility levels and usually require the help of an option pricing model to estimate.

Benefits:

Time Spreads utilize the concept of option time decay to help generate income while a stock remains in a range.

Break-even (B/E):

These are the prices the stock must remain between at expiration for the trade to remain profitable. The actual levels depend heavily on implied volatility levels and usually require the help of an option pricing model to estimate.

Many have an easier time understanding strategies when looking at profit and loss graphs. The graph below shows what the Time Spread looks like.