Wednesday

December 17, 2014

1-855-RWT-0008

Prepared by the good people at Random Walk, LLC.

This week’s POT = Jelly Roll and X-mas Rally.

Important vote on next year’s format and text book.

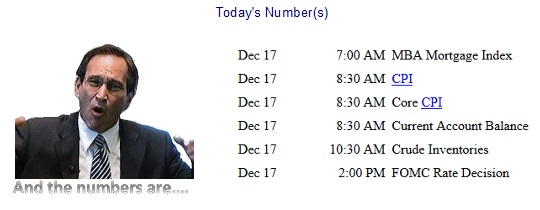

Fed Minutes on Today at 2pm

Great Morning !

Yesterday and Today

Yesterday

Insanity, hope, and then fleeting hope.

Where do I begin? The Dow opened down 99 points and oil was down $2 at 53.60. After the initial downside scare the market inched back to nearly unchanged where it looked like it would spend the day.

With the collapse of the Russian Ruble the RSX index was down 10% until it was announced that trading was being halted on the Ruble. Once that happened the Ruble ran higher and the RSX index went from -10% to up +7.4%. Think about that move! That is equivalent to the Dow being down 1,700 points and then up 1,265 points in a 15 minute period.

With that the Dow shot up 247 points, a 350 point turn around. But wait, if that were not enough….

Shortly after that the Dow, RSX, and SPX worked its way back down to unchanged. Nope…not enough yet….the market has more for us. At 1:30 eastern the markets started their advance once again, but only made it up about 94 Dow points.

Now comes the crazy stuff….

At 2:30pm (eastern) our buoyant markets declined again while the lead-balloon Russian markets stayed up. The Dow and E-minis went into a quick spiral down near the close with the Dow falling back down 111 points, the E-minis fell -18 points, Oil remained unchanged, and Russia went up a little.

The End. And in all honesty, I give up. NOTHING made sense. It was Bizzaro world and the graph is below. And trust me when I say that the day was a lot more zany than the image below depicts. It was riddled with major news about the oil, US and Russian markets.

Talks of a new Russian Revolution came up with a CNBC survey with 51% of respondents saying it could happen. An emergency meeting of the Russian Financial Council was announced. People are speculating that Putin will make further military advances into other countries, or push the Ukraine harder (which I have been saying for weeks). In short, weird news all day long.

TODAY

Yesterday

Who Knows? I have even began questioning myself this week. I understood how the markets got focused on oil so much that they could not ignore a down market. Yet that doesn’t explain how an slightly up date, or one of stabilization, wasn’t bullish and a late in the day sell-off came.

Yellen and Fed

Today we have Yellen talking and the Fed rate decision being discussed. This is always big news going in, but not always big news after. Very seldom will we have a down day after the rate announcement. We typically get a rally even if the news isn’t great, but more from the relief that the uncertainty for the month is over. The last two rate decision announcements were such non-events that if you didn’t know they were coming out, you would not have been able to tell something was released by watching stock prices.

Yesterday’s Close

I think yesterday’s close was an aberration. The markets responded so positively to oil going up $0.50 – $1.00 at one point that even I was a little surprised and thought I was witnessing the start of the Santa Claus rally. On the way up the Dow was up 130 points when oil was unchanged. So I thought if we had oil close unchanged we would have at least had a positive day. I think this is what most people were thinking, so when we started to sell off everyone jumped on thinking “what am I missing? I better get out”

All that said, if we do not close up big on the day I am going to start rethinking my belief in Santa and start looking for a Grinch. From 2:00pm to 3:00pm will say everything.

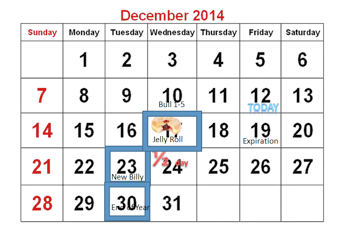

POT TONIGHT

Below is the schedule for the month.

Contract the office at 1- 855 – RWT – 0008 for more details.

Make sure you are in POT Wed for key votes on Next Year’s Format.

Jelly Rolls