Definition

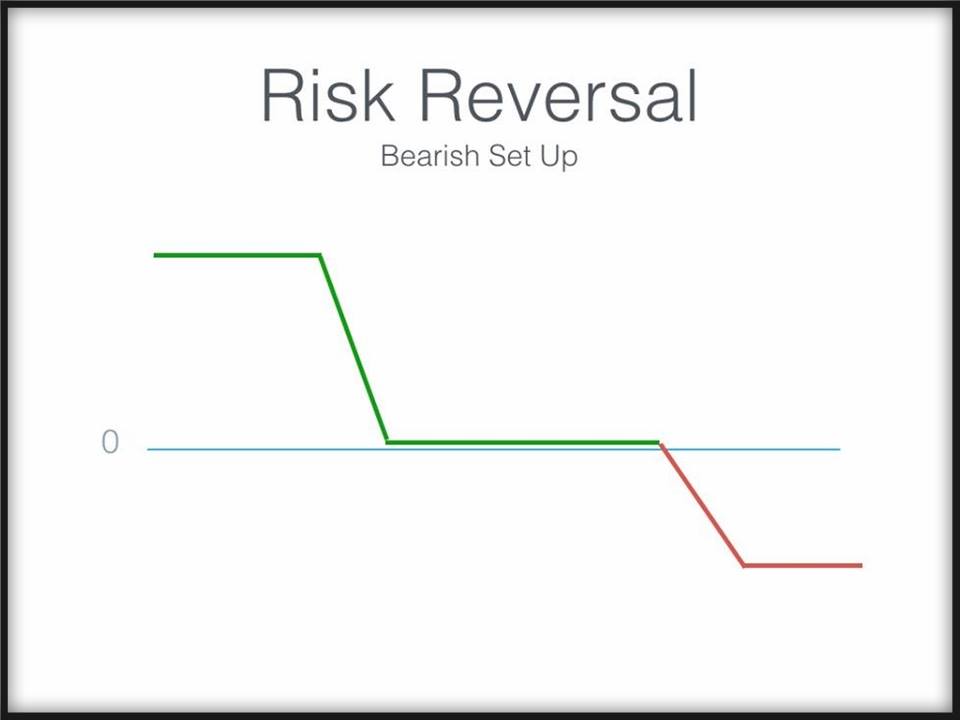

The risk reversal (which is a position when not used as a hedge) is designed to take advantage of the positive risk vs. reward ratio of the long vertical spread, and the excellent chance of success with the short vertical spread.

The best way to think of a risk reversal is as a strategic position that uses the capital from the sale of a vertical spread to subsidize the purchase of the long vertical spread.