1-3-2 Trades and other exotic trades open the world to custom designed trades with a specific individualized goal in mind. The iron cockroach would be grouped into the exotics category, and you have already seen the power these provide. As you work, you will eventually hear of the 1-3-2 trade, so it is time to introduce it.

In its simplest state, a 1-3-2 trade is a long call (or put) butterfly with a sale of a call (or put) spread inside the butterfly. The sale of the call (or put) vertical is done to receive a credit to pay for the butterfly spread. A more detailed discussion of this strategy can be found in the Practicals HomeStudy Kit.

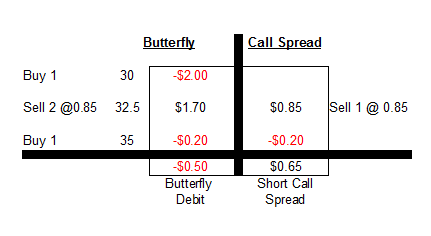

Example: Part A:

Long 30-32.50-35 call butterfly spread

Part B: Short the 32.50-35 call spread

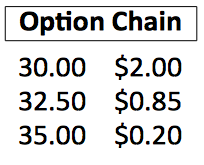

Let’s examine how the price of options makes this strategy seem sensible. We will look at an equities option chain because it is much harder to buy a butterfly for under $0.50, unless the stock is exorbitantly volatile. In a large and relatively volatile index, it is not difficult to buy a 1 strike apart butterfly for a cheap sum. With Index option, however, buying a butterfly for a small debit is much easier because of the distance between strike prices (as a percentage of the stock price itself). This is precisely why the 1-3-2 was developed to be used for equity option. If a trader elects to purchase a butterfly where the first long strike is ATM (in anticipation of the stock moving to the center strike), a $0.50 or more investment can create a substantial loss should the stock remain stagnant or move in the wrong direction. Suppose that you wanted to buy the 30-32.50-35 call butterfly because you thought the stock was going to move 1 strike higher by expiration. You look at the CALL option chain when the stock is at $30 and you see the following:

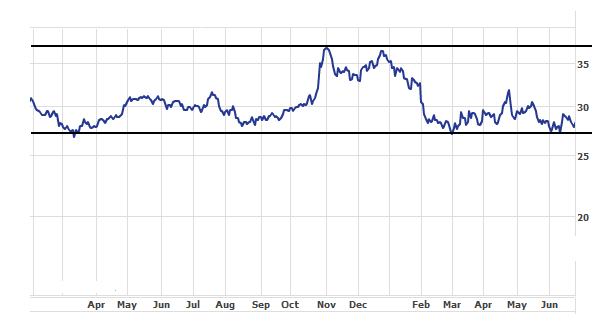

This trade is IDEAL for those stocks that are meeting resistance (using calls) or support (using puts), or stocks that are in a tight range and you are electing to play both sides of the channel. The chart below shows a decent example of an instance when a trader may elect to add the additional risk of an extra vertical call and/or put sale to lower the cost of the butterfly(s) he is electing to place.

Many people are thinking to themselves, “Can I put a put butterfly or 1-3-2 on near support levels and a call butterfly (or 1-3-2) to the upside to enhance my chances of success?” Obviously, the answer is yes. If the stock moves in the wrong direction of one of the trades (call or put), it will go out worthless and won’t harm the other.

Selling the additional call (or put) spread both increases and decreases our risk. The risk to the upside is increased, but the risk to the downside is decreased.

On a traditional butterfly, the total risk is limited to the cost of the spread. If the stock (or index) moves beyond the furthest OTM strike, the most that can be lost is the initial investment. In the example we are using, the maximum loss is $0.50. Even if the stock runs as high as $100, we can only lose $0.50, or the initial investment.

If we are incorrect in our belief that the stock was going to run higher, and the stock actually stays flat or sells off contrary to our belief, the 1-3-2 trade actually has less cost risk. Instead of paying $0.50 for the spread, we took a $0.15 credit. If the stock closes lower than $30, then all of the strikes are OTM and we get to keep the $0.15 credit. Had we done the traditional butterfly for a $0.50 debit, we would have lost $0.50.

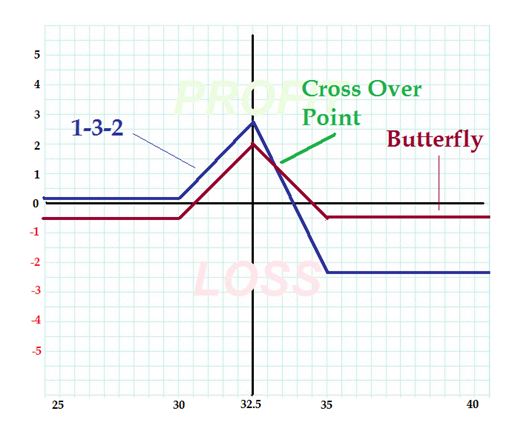

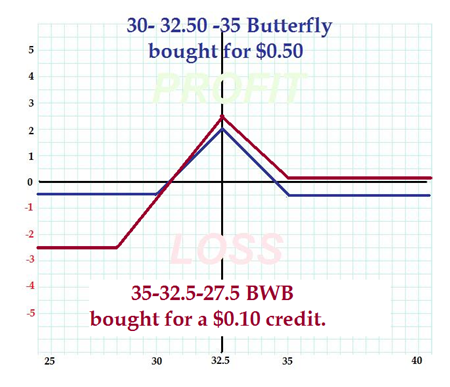

A profit and loss graph that compares the butterfly against the 1-3-2 trade, as seen below, illustrates how the 1-3-2 trade is vastly superior to the traditional butterfly until a crossover point above $33. Keep in mind that the stock was at $30 when we became moderately bullish. As long as the stock does not get above $33 (a 10% increase by expiration), the 1-3-2 trade is superior to the traditional butterfly spread. In short, any stock price below the crossover point on the graph (because we are dealing with calls) shows that the 1-3-2 trade is the better choice.

The 1-3-2 trade is the beginning of a long line of other butterfly derivatives. The broken wing butterfly (see the One Strategy for All Markets text) and the iron cockroach (see The EssentialsDVD and text) are butterfly spreads that have been manipulated to create a profit and loss scenario that are geared to risk reduction and your opinion of what the stock/underlying is capable of doing.

A butterfly is an excellent strategy but has its limitations, especially when using volatile indexes and stocks. We learned in the One Strategy for All Markets text (the green book) that the butterfly spreads will be cheaper as the volatility of a particular underlying becomes higher. But with this reduced cost comes a more difficult chance of predicting the closing price of the underlying at expiration. You can easily guess where a stock such as MSFT, which is currently stuck in a tight range between $17 and $20, will be at some point in the immediate future COMPARED to a stock like GOOG that moves $30 a day. Because the MSFT stock’s closing price is easier to predict, purchasing a butterfly becomes more expensive. This should seem logical.

BWB’s were probably conceived because of how the normal distribution curve collapses as time approaches expiration in the last week. Normal butterfly trades can be a catch-22. If you find a stock that is in a tight range and you can probably guess a closing price months prior to expiration, then the spread will be expensive. On the other hand, predicting a closing price going into an index such as the OEX during very high volatility will be difficult, but the butterfly spreads will be cheap. The BWB solves this problem at the expense of picking up a little risk. We learned in the One Strategy for All Markets text (the green book) that a BWB is essentially just a traditional butterfly that has its tails pulled out one (or more) strikes further apart to reduce the cost of the butterfly. Since most purchased butterfly spreads go out worthless, the BWB allows for more patience and tenacity when playing this spread. The downside to the BWB is that, when an extraordinary market condition like a crash occurs, the trader needs to be nimble and adjust the spread to avoid a loss. Take the example of a 35-32.5-27.50 put BWB compared to a 35-32.5-30 put butterfly (or call because they have the same risk graph). The traditional butterfly we already saw will perhaps cost us $0.50, whereas we can buy the BWB for a $0.10 credit. The two spreads have similar risk graphs for the possible price outcomes, but they are different for the other half of price outcomes (where the risk kicks in).  Those who read the green book and watched the mini-course BWB in 3 Hours will realize that the BWB is, under normal circumstances, a superior trade to the traditional butterfly. As a matter of fact, those reading this should look at the OEX weekly options and paper trade BWB’s that are ATM. Watching these collapse in the last couple days of trading is remarkable and spark a desire to play this strategy. If watched closely, these are really the most powerful trades in terms of risk versus reward.

Those who read the green book and watched the mini-course BWB in 3 Hours will realize that the BWB is, under normal circumstances, a superior trade to the traditional butterfly. As a matter of fact, those reading this should look at the OEX weekly options and paper trade BWB’s that are ATM. Watching these collapse in the last couple days of trading is remarkable and spark a desire to play this strategy. If watched closely, these are really the most powerful trades in terms of risk versus reward.

The exciting part of your education is that, at this point, you are getting sophisticated enough to play chess with the markets – not checkers. Once your mind opens to the risks and rewards by pushing and pulling option pieces around, there is literally no limit to what you can do. By merely playing with option strikes and quantities you can create risk profiles based on your opinions on the markets, support and resistance numbers, and credit/debit considerations. The “iron cockroach” that we termed is simply a manifestation of working to reduce risk and increase profit potential.